Monday Morning Wrap Up – August 31, 2020

Posted on — Leave a commentTrust in Money.

As summer winds down, the case for gold diversification grows stronger every day.

Wells Fargo’s Head of Real Asset Strategy John LaForge outlined in a research note to clients on Aug. 24 the factors that drove gold up 35% in 2020.

They are:

- low long-term interest rates

- excessive global money printing

- a weakening U.S. dollar

The fourth reason he states might be shocking to some: distrust in the global monetary system.

Here’s what Wells Fargo research said:

“Trust in money, over the very long-term, has been a fickle thing. No paper money has survived time, while gold has. Gold is history’s trusted ‘store of value.’ Trust is particularly important when we are talking about money. This is why gold, throughout much of history, has been tied to money. If history tells us anything, it is that money is only worth what someone else is willing to give you for it. If it can’t be trusted to have value, what was once money can become worthless. It seems that recent generations know little about gold and its historical role. Gold was ditched by the West as money about 100 years ago, in favor of trusting governments and institutions. The monetary system is working today, and it is largely trusted. With that said, the recent rise in gold prices and cryptocurrencies may be a sign that a small but growing contingent is questioning the world’s monetary system.”

This follows Goldman’s Sachs recent warning that the dollar is in danger of losing its status as the world’s reserve currency.

Also – notably – in early August, Russia and China revealed a new partnership – a “financial alliance” to reduce their dependence on the U.S. dollar.

These developments make the case for portfolio diversification to gold even stronger. Many investors are now increasing their allocations to gold…have you considered if you are properly protected and hedged?

Fed Announces Landmark Policy Decision to Allow More Inflation

Last week, the Federal Reserve made history by changing its long-standing practice to head off higher inflation.

Chair Jerome Powell announced that the Fed is adopting a “flexible form of average inflation targeting.”

Simply put, the policy will mean low (zero) interest rates for longer – and the central bank will now not focus on controlling upticks in inflation.

One must question the value of zero interest rate policies here in the U.S. After all, zero interest rate policies failed to deliver economic prosperity in Japan and Europe over all these years. Why will the U.S. be different?

Here’s what Paul Ashworth, Chief North American Economist at Capital Economics said about that:

“We do wonder whether the modern-day Fed is at risk of repeating the “anguish of central banking”, as originally described by ex-Fed Chair Arthur Burns in his infamous speech in the late 1970s. Burns’ argument was that he and other central bankers had the tools to control inflation in the 1960s and 1970s, but chose not to do so because “the Fed was itself caught up in the philosophic and political currents that were transforming American life and culture.” As Burns learned to his cost in the 1970s, the less focus the modern-day Fed puts on controlling inflation, the bigger the risk is that inflation will eventually get out of control.”

Gold, of course, is a historical inflation hedge, just another reason for gold ownership now.

Gold Holds Above 200-day Moving Average

In the midst of all this, gold traded quietly last week – a much needed breather from the runaway bull market that drove gold to a record high at $2,070 earlier this month. A short-term neutral range is developing as gold builds value between the $1,910 and $1,980 an ounce level.

Significantly, gold continues to trade well above its 200-day moving average (at $1,680) – which is a positive bellwether for the long-term trend – and confirms the long-term trend points higher.

As we close out summer, we leave you with this thought:

A U.S. dollar is an IOU from the Federal Reserve Bank. It’s a promissory note that doesn’t actually promise anything. It’s not backed by gold or silver. − P. J. O’Rourke

In Gold We Trust.

Regards,

David

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Why The Next Gold Rush Will Not Require a Drill

Posted on — Leave a commentThe recent surge in gold prices has reinvigorated the conversation about sourcing gold from a lesser explored source: e-waste.

Consider that every year the world manufactures electronics which, in total, contain $21 billion worth of gold and silver according to the United Nations University, a global think tank. Moreover, the same research shows that less than 15% of these precious metals are recovered after the electronics are discarded.

As the global appetite for electronics increases, so does the demand for gold and silver used in the components found within smart phones, tablets, and computers. Products like these consumed approximately 7.7% of the world’s gold supply as recently as 2011. This amount represents about 320 tons.

This lost opportunity, however, is not due to lack of resolve, or mere oversight. Instead, the gold accumulating in our landfills is due to insufficient methods and technology needed for extraction. Some believe we are entering a new era in which new solutions will enable scientist to reclaim gold and silver from e-waste.

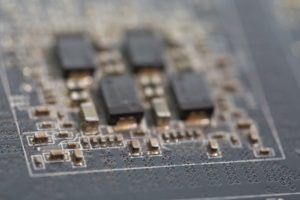

New research suggests that an organic compound called a porphyrin “possesses lots and lots of little pores that, energetically, want to host a metal atom,” according to reporting from Arstechnica. The process involves submerging electronics waste, mostly circuit boards, in an acid bath which leaches out the metals. Next, they add the porphyrin polymer which helps capture the gold. Finally, a filtration process removes the gold from the solution. This approach recovers approximately 94% of the gold dissolved from the circuit boards.

What makes this new method so appealing is not only the environmental implications, but also the economic implications. Findings published in the Proceedings of the National Academy of Sciences determined that one gram of the chemicals needed to conduct this process costs about $5 and can recover approximately $64 worth of gold. This breakthrough presents enormous opportunities given that circuit boards contain more precious metals than what can be found in the ore yielded from today’s mines. Additionally, global manufacturing of circuit boards totals 50 million tons per year and is increasing by about 8.8% annually. The next gold rush will not require a single shovel, drill, or hard hat.

The research also shows that the gold distilled from the solution is 99.6% pure. This level of purity combined with today’s rising gold process makes this new process even more attractive.

This extraction technique represents a rare double benefit in which the process of sourcing gold simultaneously reduces environmental threats presented by the accumulation of waste in landfills. In fact, if this method becomes commonplace in the coming years it might reduce the presents of traditional mining operations. This outcome could further reduce the stress placed on the environment in the search for gold.

The researchers also noted the effectiveness of the method for isolating other useful metals from e-waste. Scientists were able to extract 99.8% of metals like platinum, and palladium. Iridium, rhodium, and copper, were also successfully extracted though with lower efficiency.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Monday Morning Wrap Up – August 24, 2020

Posted on — Leave a commentElection politics take center stage.

Only 70 days until the presidential election.

The nation is hurtling towards one the most contentious and most significant presidential elections in decades.

Indeed, the political conventions are now in full swing. And, thanks to Covid, the nominating conventions are virtual.

Instead of in front of thousands of in-person delegates, Joe Biden officially accepted the Democratic presidential nomination in a virtual event last week.

President Trump and the Republicans follow suit this week in a four-day virtual, televised affair.

The election fast approaches as partisan politics reach new heights daily, the economy is mired in the worst recession since the Great Depression – with millions of workers unemployed. And, the health crisis continues to rage on – with over 176,000 Americans passing from the Covid virus this year.

Meanwhile, on Capitol Hill, negotiations on another round of emergency stimulus stalled last week as Republicans and Democrats remained far apart on ideas of how to help the millions of unemployed Americans.

Stocks Face a Tough Fall

In the midst of the economic woes, the S&P 500 closed at a record high last week!

How can this be you ask?

It’s like when you play cards.

Only in this case, the dealer is the Fed. And, the Fed is “all in” on stocks.

The Fed created trillions of new dollars in 2020 – to provide liquidity to the stock market and – in never before moves – the dealer, er the Fed, is buying corporate bonds and ETFs this year. So, the house is stacking the deck in the favor of the stock market. Nonetheless…

Challenges Loom Large

Looking ahead, the stock market faces a tough couple of months.

The contentious U.S. presidential election, rising U.S.-China trade tensions, and still the threat of another wave of the coronavirus pandemic coinciding with the seasonal flu season lie ahead. After the swift stock market run-up, a pullback is overdue.

This Week’s Main Event

The annual Fed conference in the swanky mountain town of Jackson Hole, Wyoming, will be virtual this year.

You can watch it live – a first ever for this exclusive and previously closed door Fed event.

Mark your calendar for Thursday and Friday!

The annual Fed Economic Policy Symposium, titled “Navigating the Decade Ahead: Implications for Monetary Policy,” can be viewed on the Kansas City Fed’s channel on YouTube (9:10 am, ET).

Thursday morning Chair Powell is slated to deliver his keynote speech.

What to Watch For

After the release of the July FOMC meeting minutes, it became clear the Fed is preparing to adopt an average inflation target. History continues to be made as monetary policy goes where it has never gone before…

What that means

If inflation targeting becomes official – it would open the door for the Fed to tolerate moderate overshoots of its 2% target to compensate for periods of below-target inflation.

- These changes would reinforce market expectations of a “lower for longer” zero interest rate monetary policy to support the economy once the coronavirus is finally under control.

Inflation targeting is bullish for gold. Why? Because U.S. Treasury yields would slip even lower, giving a lift to the price of gold and silver.

In Economic News Last Week

Over a million Americans joined the unemployment rolls last week.

Initial unemployment claims jumped to 1.106 million in the August 15 week, making it the biggest weekly increase since March.

Big picture: Over 50 million Americans filed for unemployment insurance since the pandemic began in March.

Key takeaway: The economy is hitting the skids again, now that the $600 per week extra in unemployment insurance expired. The economy is not out of the woods yet. It’s only stock market investors who are riding high as the Fed’s money printing benefits Wall Street more than Main Street.

Who Owns Stocks? (Not As Many As You Might Think)

While you likely own stocks, not all Americans do.

In fact, the percentage of Americans who own stock, either directly or through retirement or mutual funds, is falling. It most recently stood at about 55%, the Wall Street Journal reported last week.

In fact, “Stock ownership is increasingly concentrated among a sliver of the population. The top 10% of Americans by wealth owned 87% of all stock outstanding in the first quarter, according to data from the Federal Reserve,” the Wall Street Journal said.

That means, while you may be cheering the recent recovery in stocks, it has little impact on the day to day financial picture for about half of Americans who own no stocks at all.

Gold Enters Much Needed Consolidation Phase

In the meantime, after the historic, runaway bull market that drove gold through the $2,000 mark earlier this month, the precious metal has entered a short-term consolidation phase.

Just like a car that raced at top speed for hundreds of miles and is now out of gas, the gold market has reached a temporary stalling point.

Sideways consolidation in gold is likely for at least a few weeks, as the gas tank refills.

Where gold might go in the future

The underlying fundamentals for the gold market have not changed. Major investment firms continue to forecast higher gold prices. Goldman Sachs expects gold to climb to $2,300 an ounce within 12 months. Bank of America raised its 18-month forecast this April to gold at $3,000 an ounce.

Until next week…

Regards,

David

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Guess Who’s Taking A Position In Gold Now?

Posted on — 2 CommentsThe list of venerable Wall Street firms, hedge fund managers and billionaires who are betting big on gold in 2020 is nothing new. But this is.

Stop the presses!

Warren Buffett’s Berkshire Hathaway Inc. just announced a $565 million stake in Barrick Gold Corp. – the world’s second largest gold miner.

Why is this big news?

Historically, Buffett has said he doesn’t favor gold investment plays.

Apparently, 2020 is different. But, we all knew that already.

All across the globe – investors big and small are participating in one of the most historic moves into precious metals – which saw gold soar to a new all-time record high at $2,070 earlier this month.

Listen to what one billionaire said in January – before the pandemic hit.

At the World Economic Forum in Davos, Switzerland, earlier this year, Ray Dalio, founder of Bridgewater Associates, said investors should hold a global diversified portfolio that includes gold. “Cash is trash,” he said. He warned that investors should get out of cash as central banks continue to print money.

When it comes to a store of value, central banks will continue to prefer to hold hard assets, he noted. “What are [central banks] going to hold as reserves? What has been tried and true? They are going to hold gold. That is a reserve currency, and it has been a reserve currency for a thousand years,” Dalio said.

Fast forward, into the Covid crisis and Dalio’s fund has furiously been adding gold to their holdings.

- Billionaire Ray Dalio’s hedge fund Bridgewater & Associates bought more than $400 million in gold in the second quarter of this year!

Earlier this year, Dalio told Bloomberg that investors would be “pretty crazy to hold bonds” in this period. “If you’re holding a bond that gives you no interest rate, or a negative interest rate, and they’re producing a lot of currency and you’re going to receive that, why would you hold that bond?” Dalio said.

Another billionaire bond investor Jeffrey Gundlach – the CEO of $135 billion DoubleLine Capital believes that gold prices will go higher in the long-term.

Gundlach pointed to the U.S. budget deficit, which exploded higher this summer because of coronavirus stimulus packages

“If we are going to continue that type of a pace, we’d be looking at over 50% of GDP in terms of the budget deficit, which is getting almost surreal in terms of what’s happening,” Gundlach added.

“Gold will ultimately go much higher because I think the dollar’s going to go much lower,” Gundlach said.

Who else is recommending gold right now?

In July, Goldman Sachs increased their 12-month forecast in gold to $2,300 an ounce.

The recent surge in gold prices to new all-time highs has substantially outpaced both the rise in real rates and other US dollar alternatives, like the Euro, Yen and Swiss Franc,” Goldman analysts wrote.

“We believe this disconnect is being driven by a potential shift in the US Fed towards an inflationary bias against a backdrop of rising geopolitical tensions, elevated US domestic political and social uncertainty, and a growing second wave of COVID-19 related infections,” according to a Goldman Sachs research note to clients. “With more downside expected in US real interest rates, we are once again reiterating our long gold recommendation from March and are raising our 12-month gold and silver price forecasts to $2300 an ounce.”

In April, Bank of America raised its 18-month forecast in gold to $3,000 an ounce citing the zero interest rate environment in the U.S. as a key driver for higher gold. The size of major central bank balance sheets has been stable at 21 to 28% of GDP in the past decade just like the gold price,” analysts Michael Jalonen and Lawson Winder wrote. “As central banks and governments double their balance sheets and fiscal deficits we up our 18m gold target from $2000 to $3000/oz.”

Other major global banks have also jumped on the gold bandwagon.

Swiss bank – UBS said this: “We’re bullish on gold and have been adding it into our managed portfolios in recent weeks,” a UBS team led by Kiran Ganesh wrote.

While gold has retreated in a correction phase – after setting a new all-time record high at $2,070 earlier this month, the rally is far from over.

While gold has taken a breather, Manpreet Gill, head of fixed income, currencies and commodities at Standard Chartered told CNBC’s “Street Signs Asia” “We think gold’s run … hasn’t quite finished yet.”

“It comes back to interest rates. One of the best explanations of why gold has surged the way it has through this year have been bond yields,” Gill said.

He said it is “ultimately a great environment” for gold assuming central banks continue to keep bond yields low, quoted in an Aug. 18 Business Insider story.

Wall Street’s best and brightest minds remain bullish on the outlook for gold ahead. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Three Factors Indicating the Future for Gold After Reaching an All-Time High

Posted on — Leave a commentBy the first week of August gold reached an all-time high of $2,059 per ounce.

While increases like this can arise from a number of circumstances, it seems reasonable that a pervasive sense of uncertainty is one of the biggest contributing factors. Consider that this run-up is happening at a time when consumer demand for gold has fallen sharply. Jewelry sales fell by approximately 46% in the first six months of 2020.

Gold investors have enjoyed this recent boom. Yet, the surge in prices is so strong that many have questioned where prices go from here. Answering this question means understanding how the most influencing factors will unfold in the coming months. These factors include:

- The Strength of the US Dollar

- The Pandemic

- Economic Policies

The Strength of the US Dollar

Gold is priced in USD. Therefore, when the value of the dollar diminishes an individual needs more dollars to acquire the same amount of gold. This concept also applies when the USD is strong and the price of gold decreases because fewer dollars are needed to purchase the metal. Since mid-May of this year the value of the USD has fallen considerably. This drop is likely one reason why gold has climbed in value. The important question is this: what will happen to the USD in the future? This, of course, is a question that no one can answer definitively. However, analysts at Goldman Sachs believe this “decline in the USD is just the beginning of a larger structural downtrend in the greenback driven, in part, by a further recovery in the global economy.” These same analysts are forecasting a 20% drop in the value of the USD from the recent peak reached at the end of the first quarter of this year.

The Pandemic

Uncertainty is also driving the value of gold. The connection between uncertainty and gold prices has been studied and findings published in The Journal of Quantitative Finance determined that “economic policy uncertainty is positively correlated with gold price.” This finding begs the question: where does US economic policy uncertainty stand today? The answer can be found in the US Economic Policy Uncertainty Index which was at the highest point ever recorded as recently as June of 2020. The index ties together an analysis of media coverage of the economy, the anticipated retirement of tax code provisions, and disagreement among economic forecasters. This sentiment echoes the sobering words of U.S. Federal Reserve Chair Jerome Powell who warned that the current environment is “extraordinarily uncertain.” A return to “normalcy” is unlikely to take shape anytime soon. While uncomfortable in many respects, this setting should be supportive for current and future gold prices.

Economic Policies

The future of economic policy in the US also remains murky. We are less than 100 days from the presidential election and, until we see the outcome, we know little about the plan for the country. This has left many investors ambivalent about the equities market and has perhaps been a reason for the heightened volatility we are seeing today. In this setting, long-term stores of value, like gold, are attractive because they give people a place to preserve wealth with a reasonable degree of certainty. No matter who becomes president it is nearly assured that a full recovery from the devastation of the ongoing pandemic is a long way away.

These three factors should remain top of mind for gold investors seeking to understand if the recent historic increase in value can be sustained. An examination of USD strength, the pandemic, and unsettled economic policy seem to indicate that current gold prices will likely remain, or even climb in the coming months.

The Difference Between Wealth and Money

Posted on — Leave a commentMoney is transitory. It is the only way to transact business/pay bills. From the beginning of time, this has always been the role of money.

Wealth is different. Wealth is measured in real things. Property. It always has been and always will be.

In the United States, wealth and money (dollars) have become intertwined over the past fifty years or so. This is a recent phenomenon and is only due to the dominance of the US dollar on the world stage. The incredible worldwide respect for the dollar has allowed it to be considered a stable and valuable store of value. This has been evidenced by the fact that the dollar has always allowed you to earn a nice rate of interest by simply holding it in the bank. You could do nothing and make a decent return simply because you held dollars.

In July, the dollar posted its biggest monthly drop in value in a decade. This is likely, in part, what prompted Goldman Sachs to warn that the dollar was in danger of losing its status as the world’s reserve currency. In turn, Goldman stated “We have long maintained gold is the currency of last resort, particularly in an environment like the current one where governments are debasing their currencies and pushing real interest rates to all-time lows.”

Clearly, the days of easy interest are over. More than $10 trillion is sitting in money market and savings accounts making nothing. If the dollar had any level of respect left worldwide and this money was able to earn just 1% that would represent $100 billion in wealth created a year!! That is the magnitude of what has been lost. $100 billion a year at just a 1% interest rate.

Why can’t you make any interest? Because no one wants your dollars. They can get as many as they want from someone else. Is that where you want to store your wealth? In something that, returning to the norm, no one else really wants?

So what is really happening? A massive transfer of wealth is taking place right now. Massive.

Need proof? Those that transferred dollars to gold just one year ago have grown their wealth by 33%. Those that transferred dollars to silver just one year ago have grown their wealth by 43%.

This change is simply a return to the norm and is only beginning. Despite how obvious this is, very few have figured out what is happening. Ask yourself a simple question: Is the United States government going to print more money over the next ten years? If the answer is yes, you have a choice. Sit and do nothing and allow your dollar value to continue to be watered down, or take the responsible steps and build wealth for you, your family and your heirs.

Every day we hear about more and more trillion dollar “rescue” programs being passed by politicians. Rather than pay for these massive trillions upon trillions of dollars in handouts with taxes, the government simply prints the money. It is all really a clever way for the government to tax you without calling it a tax. How much is the tax? It’s equal to the gain in the value of gold over the past year – 33%!! Think about that. By doing nothing with your paper dollars in the bank over the past year, you were subject to a 33% tax.

Will you sit and be taxed on your dollars or make the transfer? If not now, when?

Read this article to learn more: The Hidden Risk of Money Market Funds

Monday Morning Wrap Up – August 17, 2020

Posted on — Leave a commentConsumer inflation heats up fast.

Is the inflation genie out of the bottle? Once it has escaped, policymakers know it is very hard to get it under control…

New data last week revealed that July Consumer Prices jumped higher. The annual core CPI inflation rate rose to 1.6%.

Here’s what costs more now: Gasoline prices increased by 5.6% m/m in July, motor vehicle insurance prices increased by 9.3% m/m last month, air fares increased by 5.4%, used vehicle prices rebounded by 2.3%, lodging away from home rates increased by 1.2%, clothing prices increased by 1.1% and new vehicle prices increased by 0.8%, Capital Economics noted.

Here’s what new research titled: “Inflation collapsed in 2Q, but it’s rising fast now” from a BofA Global Research report says:

“Inflation initially collapsed in 2Q20 as the pandemic hit, but it has recovered quickly in recent months as central banks engaged in unprecedented easing. In turn, the aggressive expansion of monetary and fiscal policy in the US has led to fears of US currency debasement and overshooting inflation.”

It’s no wonder gold prices surged an astonishing 35% higher from Jan. 1 into the August high! Gold is an excellent inflation hedge and now official numbers are beginning to capture the impact of the Fed’s massive money printing scheme.

The Gold Rally Pauses

Last week we saw the gold rally correct and consolidate. No, this does not mean the gold rally is over – far from it!

In technical terms, the gold rally was ‘overbought and due for a correction.’

After all, since July 1st gold surged from $1,769 an ounce to the $2,059 level — that’s a massive move in a short period of time.

Corrections are normal in all markets and the gold rally simply ran out of gas in the short-term and needs time to consolidate and build value at its new higher price point. The fundamentals remain strong for gold and silver.

For the short-term, expect gold to move into a holding pattern as it gains strength for its next move higher with a target at the $2,300 an ounce level.

Congress Takes a Break

As political jockeying continued, the U.S. House and Senate failed to come to terms on a new Covid-19 stimulus package before leaving for their August recess last week. Congress isn’t slated to return until Sept. 14 (for the House) and Sept. 8 (for the Senate).

Covid Infections Leveling Off

In the midst of the political bickering, new Covid-19 infections in the U.S. appear to be plateauing for now. The daily number of new Covid cases stood around 55,000, roughly the same as a week ago and steady for the past two weeks.

The daily national Covid-19 spread rate is now down to around 1% per day as of August 12. That has fallen to near the lowest levels of the pandemic so far and down from a recent high of 2 percent.

The focus is shifting to a potential second wave that could be sparked by schools returning to in-person learning and the onset of the fall influenza season.

Covid Rates Are Still High In South and Sun Belt States

Key economic driver states like California, Texas and Florida, however, have already started reinstating restrictions on indoor and group activities due to rising Covid cases there. In total, there are 21 states that account for 30% of the U.S. economy that have either reinstated restrictions or paused their economic reopening plans, according to S&P Global.

“As more states reverse plans for reopening and the U.S. government negotiates the next round of emergency stimulus to keep the economic recovery on track, recent real-time economic data continues to be mixed,” according to Beth Ann Bovino, U.S. Chief Economist at S&P Global.

“S&P Global Economics still sees the probability of a worse economic outcome–than its base-case projection–at 30%-35%. Although our base case is for a gradual recovery through next year, still-high levels of COVID-19 infections, together with no agreement in extending emergency COVID-19 relief, suggests that the near-term outlook remains challenging,” Bovino said.

Global Pandemic Picture

Total Covid-19 cases in the United States have topped the 5.3 million mark, as we continue to lead the world in the highest number of infections. And, tragically, more than 160,000 Americans have lost their lives to this pandemic.

Brazil is in second place with 3.3 million cases and India is third with 2.5 million cases, according to data from Johns Hopkins University.

Coronavirus Vaccine

Looking ahead, the CDC predicts initially we could have 10 to 20 million doses of a Covid vaccine – by year-end perhaps. However, there are 100 million Americans who are considered ‘high priority’ – people who work in essential jobs like health care or front line workers and those with high risk conditions. It will likely take up to two years before there is enough manufacturing capacity for all 320 million Americans to get access to a vaccine.

Disconnect between Stock Market and Economy Continues

In the midst of all this economic uncertainty, the stock market is flirting with its all-time highs despite the fact the economy isn’t anywhere close to previous levels of output.

It’s like Charles Dickens’ novel: A Tale of Two Cities.

Stocks are climbing against a backdrop of record economic damage in the U.S.

Chalk it up to massive money printing by the Fed – once again fueling a liquidity driven move in speculative and risky assets.

Is it sustainable? That’s why investors diversify – into tangible assets like gold and silver.

Where’s the Mail?

Last, but not least, it turns out the post office could end up as a central player in the next U.S. Presidential election. As unlikely as that would have sounded just 8 months ago – it may be true.

As the call for mail-in balloting increases so Americans fearful of the Covid pandemic can protect their health and vote by mail, there are concerns budget cuts could delay delivery time.

The election is fast approaching and could be a major flashpoint for the stock market and precious metals.

Financial markets do not like uncertainty – and there remains much uncertainty over perhaps the most divisive presidential election in decades.

The Bottom Line

This historic global gold rush into gold remains intact. Major investment firms continue to point to higher gold prices over the next 12 months with targets at $2,300 and even $3,000 an ounce. With widespread vaccination for Americans still one to two years out, and a watershed presidential election just around the corner, gold is money you can count on to protect, preserve and grow your wealth.

Stay safe,

David

The Uniquely American Appeal of the $3 Indian Princess

Posted on — Leave a comment In 1854 the U.S. Mint’s chief engraver, James B. Longacre, reached a milestone in his career. For the first time, he would choose the design for a piece of currency: in this case the three-dollar gold coin. Much of the currency up to that point favored designs that referenced the Romans and the Greeks. However, Longacre decided to go in a different direction.

In 1854 the U.S. Mint’s chief engraver, James B. Longacre, reached a milestone in his career. For the first time, he would choose the design for a piece of currency: in this case the three-dollar gold coin. Much of the currency up to that point favored designs that referenced the Romans and the Greeks. However, Longacre decided to go in a different direction.

He wanted to choose something that was closer to the American identity rather than imagery from “the barbaric period of a remote and distant people.” He decided instead to depict Liberty in an Indian princess headdress. For Longacre it seemed more important, and more interesting to choose this design which was more emblematic of the frontier and of America as a whole. The reverse side consisted of an agricultural wreath of corn, tobacco, cotton, and wheat. This also was an image selected to properly represent aspects of life that felt uniquely American. It seemed that, in many ways, Longacre wanted to make a design that was undeniably his own and, in identifying so deeply with the American spirit, he had to allow this sense of Americana to flow through the look of the coin.

While the design carried much spiritual weight, the origin of the piece was due to far more pragmatic reasons; a $3 coin would be a simpler denomination for the practical purposes of purchasing things like a sheet of 3-cent stamps. Additionally, the substantial gold content of the piece (90% gold, 10% copper) would make good use of the ample gold deposits found in California at the time.

Longacre’s decision to adorn the coin with Native American representation was a impactful given that the production was the largest of any three-dollar piece ever produced by the Philadelphia Mint at that time. Soon after more pieces were struck at the San Francisco Mint. Despite the practical need for a gold three-dollar piece the coin experienced backlash as many complained that the denomination was not as clear as it could have been. Therefore, in 1855 the words “Dollars” were enlarged in the design to help distinguish the piece from the quarter eagle coin for which it was occasionally confused.

By the early 1860s, the circulation of the coin became limited, especially in regions like the East and Midwest, as gold and silver became scarce amid the upheaval of the Civil War. Despite this, the Mint continued to issue the coin until 1889 when Mint Director James P. Kimball remarked that the denomination served no useful purpose and was sought after only by the occasional collector. Soon after, officials decided to cease minting the coin and melt the pieces that remained at the Philadelphia Mint.

While the coin did not enjoy as much popularity or circulation as other pieces it accomplished something far more important. Longacre’s design introduced imagery of Native American’s more deeply into the fabric of the country. His work represents a juncture where the identity of the country became more enmeshed with its own history rather than the romanticized notions of the Greeks or Romans. The Indian Princess three dollar coin is a true American piece.

Monday Morning Wrap Up – August 10, 2020

Posted on — 1 CommentThat didn’t take long.

As the historic precious metals rally in 2020 continues, gold hit a major milestone last week at the $2,000 per ounce level – and kept on going!

Spot gold traded as high as $2,059.90 last week as the coronavirus pandemic created the perfect playbook for gold and silver to perform strongly.

Global central banks and governments continue to flood the economy with stimulus and cash which has lifted demand for tangible assets like bullion. With official Fed interest rates at zero – holding gold and silver is more appealing than ever. After all, there are really no interest-bearing assets for gold to compete with in today’s environment.

Interest Rates Plunge, Is Negative Next?

In fact, U.S. 30-year fixed mortgage rates plunged to an all-time record low at 2.88% last week.

That marked the eighth time since the coronavirus recession began that mortgage rates sank to a new low. This has sparked a flood of refinancing for existing home owners – if they have a job and can qualify under the financial industry’s tighter underwriting procedures in the midst of the pandemic. Banks are not eager to extend credit to consumers in the midst of the high unemployment rate and uncertain economic outlook.

The 10-year Treasury yield flirted with all-time record lows at 0.514% last week. Buy a 10-year note – and earn 0.514% interest? Not very appealing indeed.

Negative interest rates have never existed in the U.S.

There are some experts who warn this could still happen here.

Negative interest rates in the US “are still possible,” according to a research note published last week by DataTrek co-founder Nicholas Colas. Indeed, earlier in 2020, President Trump called on the Fed to implement negative interest rates in the United States, so that the government can take advantage of low borrowing rates.

Wondering how that would work – and what it would mean for you?

If interest rates go negative – that means that banks charge you – the account holder – a fee to hold and store your money in their bank. It’s no wonder investments in gold are soaring this year.

U.S. – China Tensions Continue to Escalate

Last week, the Trump Administration struck back against Chinese technology companies.

The president implemented an executive order that would effectively ban TikTok and WeChat in the U.S. In China, WeChat is the primary chat app for consumers and also a major tool for payments, shopping and business transactions – with an estimated 1 billion users there.

It is similar to platforms like Venmo, Apple Pay or PayPal, here in the United States.

However, the parent company of WeChat includes a massive array of companies including video games studios, music companies and social media apps.

The rising U.S. – China tensions have fueled massive gold buying in Asia.

Precious metals sales surged 70% this year at Emperio Group, a retail store for precious metals in Hong Kong. Customers there are buying buying gold bars and coins because of low interest rates on bank deposits, while others are worried about U.S.-China tensions, the Wall Street Journal reported.

U.S. Starts Trade War with Canada

It’s not just China that the U.S. is wrestling with. Last week, President Trump said he will impose a 10% tariff on “non-alloyed unwrought aluminum” imports from Canada starting this month. Canada stated that it would retaliate fully and that the government intends to impose countermeasures on U.S. products that will total CAD 3.6 billion.

Jobs Data Shows Progress – But a Drop in the Bucket Really

Last week, the U.S. Labor Department reported that 1.8 million new jobs were added to the economy in July. Sounds positive right? Remember, the U.S. economy is still down 13 million jobs since the pandemic began, with the overall unemployment rate still in double digits at 10.2%. Bottom line? The labor market remains in a recession and on shaky ground.

Precious Metals – Top Performing Asset Classes in 2020

The global rush into precious metals is monumental. Even as the stock market edges higher, investors remain skittish about the economy, geopolitical tensions, the upcoming U.S. presidential election and the long-term damage to the U.S. dollar from the Fed’s massive money printing scheme.

In the midst of the Covid crisis, gold and silver are the second and third top performing asset class this year.

What’s first? Surprisingly, lumber with a 60% gain in 2020. Chalk that up to scarcity and supply issues in a thinly traded market during the pandemic.

Behind lumber, silver is the second best performing asset class with a 52% gain year-to-date. Gold is turning in a remarkable 30% gain year-to-date.

The big question on everyone’s mind is will gold prices keep rising?

Here’s what Edmund Moy, previous director of the U.S. Mint said last week: It took three years after the start of the previous financial crisis for gold prices to peak. This crisis is far from over!

Goldman Sachs and Wells Fargo Investment Institute see gold gains to $2,300. In April, Bank of America Corp. raised its 18-month gold-price target to $3,000 an ounce – in its well named “The Fed Can’t Print Gold” research report.

Will Silver Outperform Gold Ahead?

While gold has been in the spotlight, silver is on a record run too this year.

In fact, July represented one of the best months for silver on record, and its highest monthly gain since 1979.

Silver bullion coin demand is robust in 2020, up over 60 percent to-date this year.

Notably, the gold: silver ratio — the quantity of silver ounces needed to buy an ounce of gold –peaked at 127:1 on March 18 and now stands at 72:1, a decrease of 43 percent.

Over the medium term, Bank of America sees potential for silver to rally to the $50 an ounce level.

Given the strong rally in gold – to a major milestone at $2,000 an ounce – a breather wouldn’t be a surprise. Markets don’t go straight up or down forever. Markets need time to consolidate and catch their breath.

Gold has hit a new all-time high – many think silver will be next.

Silver still trades well below its all-time high – at nearly $50.00 an ounce in late 1979.

The gold-silver ratio still reveals that silver is historically undervalued to gold – Readings above 65 signal that silver is severely undervalued and is a strong buy signal for the metal.

Look for silver to move into a leadership role in the next few months – as the next wave of this historic precious metals rally continues to unfold.

Just as you buy gold to diversify your stock portfolio, it is wise to diversify your tangible assets allocation. How much silver do you own? There’s a lot of runway between current prices and the all-time high in silver. Check out the historical price chart of silver here.

Until next week!

Best,

David

Could Covid Kill the Penny?

Posted on — Leave a commentSee a penny pick it up –and all day you’ll have good luck!

Remember that old rhyme? It could become a relic – along with the penny if some cost cutters get their way.

The Covid-19 pandemic has created a nationwide coin shortage. Shoppers are relying on debit and credit cards to avoid touching cash, which can carry germs, but that’s left parts of the nation short on spare change.

Here’s what the Federal Reserve said recently:

“Business and bank closures associated with the COVID-19 pandemic have significantly disrupted the supply chain and normal circulation patterns for U.S. coins. While there is an adequate overall amount of coins in the economy, the slowed pace of circulation has reduced available inventories in some areas of the country.”

The current coin shortage has revived the debate on whether or not we actually need the penny anymore!

Former Arizona Congressman Jim Kolbe spent several decades trying to kill the penny – by introducing legislation every year, but always got blocked.

Today – amid a coin shortage – experts are now debating the fate of the penny again.

The purchasing power of the penny has fallen because of inflation, while production costs have climbed.

In fact, the government loses money every year on minting pennies. It costs the government about 2 cents to make a penny. Indeed, the United States Mint manufactured more than seven billion pennies in the 2019 fiscal year, at loss of nearly $70 million, the New York Times reported.

While it could be a cost effective move for the government to say goodbye to the penny, there are many, however, who believe the penny should remain part of our coinage. It was one of the first coins minted by our country after all.

Notably, older pennies are made primarily of copper – which it turns out is antimicrobial. New pennies are made primarily from zinc, not copper.

The U.S. wouldn’t be alone if it makes this decision. Other countries like Canada, Britain and Australia have stopped making their smallest denomination coins. There is historical precedence – in 1857, Congress discontinued the half cent.

Feeling sentimental about pennies? Shop our cent inventory here.

Suggested Reading: