The Gold Standard Could Gain New Momentum

Posted on — Leave a commentWith the presidential election results under investigation, gold investors turn their focus to the Senate this week.

Judy Shelton, an economic advisor to President Trump, is most famous for her advocacy for a return to the gold standard. And, her long-standing criticisms of the Federal Reserve.

This week – there is a historic opportunity for President Trump – to put his personal stamp on the Federal Reserve with his nomination of Judy Shelton to the central bank.

If, as expected, the Senate votes to confirm her this week – she’ll have her chance to reshape the long-term direction of the Federal Reserve.

Throughout her career as an economist for institutions including the Hoover Institution, the Sound Money Project and the European Bank for Reconstruction and Development she has been a staunch conservative voice in the economic community.

In fact, Shelton has long advocated that the United States return to the gold standard – which would tie the value of the dollar to physical gold.

Notably, Shelton has called into question the underlying mission of the Federal Reserve which is to promote maximum employment, along with stable prices. She has also called for closer ties between the White House and the Federal Reserve on policy making measures, which would be a break from a long-standing tradition of central bank independence.

Now, Republican Senators appear poised to vote to confirm her to the nation’s most important monetary policy board. Republication Senator Lisa Murkowski from Alaska, often considered a key swing vote, announced late last week that she had decided to support Shelton.

Republication Senator Pat Toomey from Pennsylvania, agreed to vote for Shelton after she pledged in writing that she “would not advocate for the devaluation of U.S. currency” and agreed the Federal Reserve does not have authority to use monetary policy to devalue the dollar,” according to The Hill.

If the Senate votes to confirm Judy Shelton to the Federal Reserve Board this week – a strong voice for gold will have a seat at our nation’s monetary policy making table.

A little history

The U.S. went off the gold standard under President Nixon in 1971. Currently, the U.S. does have the largest official gold reserves in the world at 8133.5 tons, according to the World Gold Council. Just for comparison, Germany is a distant second with 3,362.4 tons and the IMF in third place at 2,814 tons.

So, the U.S. has a lot of gold, but is it enough to back our nation’s $27.2 trillion government debt? Not even close.

Here’s some back of the envelope numbers to consider. One ton of gold equals 2,204.62 pounds. One pound of gold equals 14.58 ounces. Even if we liquidated the entire nation’s gold supply, it would not come close to covering our nation’s debt.

The next step to return to the gold standard would be for the government to revalue gold – it could make gold go up as much as 1,000% by some estimates.

Advocates of the gold standard note that it would give our country the fiscal discipline – it would force all of us, governments and citizens alike, to be more fiscally responsible.

However, a return to a pure gold standard may not be feasible because of the dollar amounts we are talking about.

It is more likely that a new system – a hybrid gold standard could be put in place. This would mean that the government would peg a portion, say 25% of the dollars out there, would be tied to gold.

The upside of this type of hybrid plan? This would give the dollar some sort of protection that it can only lose this amount, because it is backed by gold. Right now it is backed by a promise.

Many economists do believe that the odds are remarkably high that we will see gold play an increasing role in the monetary system over the next ten years.

If the Senate votes to confirm Judy Shelton this week, expect to start hearing more about the gold standard in the months ahead.

For gold investors, this means that owing a small portion of your portfolio in gold protects you and also puts you in a position for a financial windfall if we do see a return to the gold standard.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Why Investors Are Turning to Alternative Stores of Value

Posted on — 1 CommentWith the U.S. dollar index down 10% this year and inflation stirring, it’s a great time to diversify investments with blue chip rare gold.

A generation ago, it was common to find rare coins, collectible books, art masterpieces and extensive wine collections only in the homes of the wealthy upper class.

Today, investor movement toward alternative stores of value has exploded.

In fact, middle class investors want in on these smart money tangible investments too – as a method to diversify their portfolios, protect their assets and grow their wealth. Interestingly, technology plays a part in opening access to these asset classes to middle class investors.

For example, there are start-up companies that now allow investors to buy small portions (shares) of art masterpieces, or a wine investing platform that allows you to invest in wine without having to store it yourself.

So why the rush into alternative investments?

Inflation is pushing investors into alternative stores of value.

Zero interest rates mean bond investors lose money on their investments after inflation. Even worse, the U.S. dollar index has tumbled 10% in 2020 alone. This comes as “real concerns around the longevity of the U.S. dollar as a reserve currency have started to emerge,” wrote Goldman Sachs analysts in a recent research note.

The Federal Reserve is devaluing the U.S. dollar by printing trillions of new dollars this year alone, as it pumps unprecedented amounts of cash into the economy.

While the pandemic rages on in 2020, the precious metals and rare coin sector is glittering. Gold hit a new all-time high above $2,000 an ounce earlier this year. The rare coin values index hit new all-time highs throughout the summer months. Indeed, history shows us we are just at the starting point. We are on the cusp of a new multi-year bull market in rare coins, thanks to building inflation pressures.

Gold is off its highs but is still up 23% for the year. Silver is up 34%. That compares to a 5% gain in the S&P 500 index and a 0.80% yield on U.S. Treasury notes.

Simply put, investors are diversifying with alternative investments like numismatics, gold bullion, cars, art, sports memorabilia, wine, and whisky because inflation is on the rise and the U.S. dollar is weakening.

The Fed let the inflation genie out of the bottle

In order to have inflation you must have a huge amount of money that has been created out of thin air by the Fed. Of course, the Fed has already done this. Never before in history has there been so much excess cash sloshing around in the U.S. financial system.

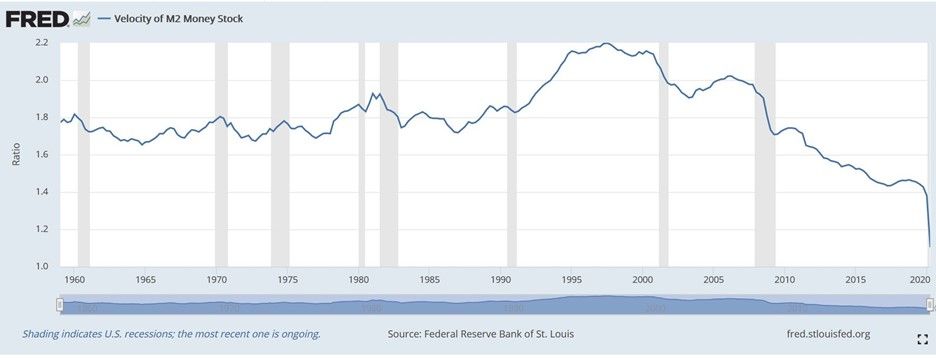

Second, you need that money to change hands and the faster it changes hands, the more inflation rises. If you look at the following chart from the St. Louis Federal Reserve, you see that the velocity of money has never been lower. The velocity of money simply means the number of times one dollar can be used to purchase final goods and services included in GDP.

Money velocity is going to change. As you can see, the drop off in 2020 has been huge and quick. That can go the other way as well.

For investors, now is the time for you to prepare for wealth storage and preservation. Because if you wait, it could be too late.

Some may ask, if inflation is an increase in money and credit beyond the growth requirements of the economy, then why don’t we see inflation, or hyperinflation, today?

Step one is increase the money supply as much as you can. Of course, we have witnessed that over the last several years with the massive Fed money printing. What we have not seen is the turnover of that money. Once that increases, inflation will move upwards very quickly.

Inflation starts slow, but then heats up fast

Think about inflation as the oven you just turned on to 500 degrees. At first you can put your hand inside and feel a little heat. Ten minutes later it is 500 degrees. It happens very slowly at first. Then very fast. Well, the oven has been on for a long time and the Fed just keeps turning the oven up. Its warm right now but it will be too hot to touch in the very near future.

The Fed has set the stage for a new bull market in rare coins. We are on the cusp of that now.

Here is another chart – the PCGS Key Dates and Rarities Index from 1970-2019. This shows you how significant the 2001-2008 rare coin bull market truly was. Today, we are in the early stages of another rare coin bull market just like we saw begin in 2001.

Rare coin market tightens as investor demand grows

Here at Blanchard, 2020 has seen numismatic investor interest shift from mid-level rare coins, to ultra-rarities. Indeed, the high end of the rare coin market is tighter than its been in over a decade.

Not long ago, clients had their pick of coins in the $10,000 to $30,000 level. Now, coins in that price range have become nearly nonexistent and those that are located are placed immediately.

For instance, CAC graded rarities are extremely scarce and hard to come by right now. That compares to this same time last year, and we could source almost any coin with a CAC sticker.

Here are some rare coins that are on the cusp of a multi-year bull run that we’ve recently sold. We can’t keep them in inventory – they sell as soon as we are able to source them.

- 1854-O $20 Liberty

- 1907 $20 Saint GaudensFlat Edge High Relief HI FLT

- 1866-S $20 Liberty

- 1931-D $20 Saint Gaudens

- 1920-S $10 Indian

- 1907 $10 Indian Wire Edge

- 1911-D $2 1/2 Indian

- 1863 $1 Gold Deep Cameo

Weaker dollar, rising inflation impacts all alternative asset classes

It’s no surprise the ultra-rich still favor alternative stores of value.

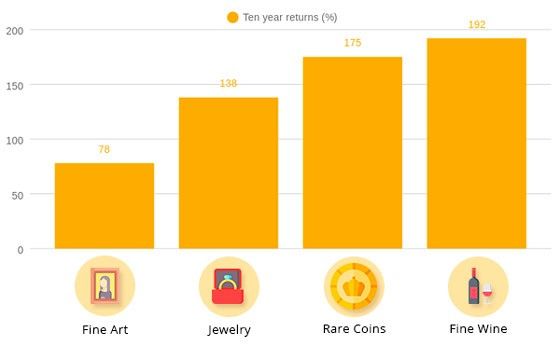

The results of the 2020 Knight Frank Luxury Investment Index revealed that ultra-high net worth individuals, or those with a net worth of over $30 million, continue to favor cars, wine, coins, rare whisky, and art as alternative investments. And those categories outpaced luxury investments (like stamps, colored diamonds, watches and handbags) over a 10-year period.

The report found that rare coins are up 175% in past decade.

How are other assets classes doing now?

In a Knight Frank Luxury Investment update last week, the firm found that the art market has been reined in by COVID-19 and the classic car sale market has also slowed.

The top end of the art market has been particularly badly affected by the pandemic.. According to a report by analyst Clare McAndrew, published by Art Basel and UBS, gallery sales dropped by 36% in the first half of the year compared with the same period in 2019.

Meanwhile, the auction market for classic car sales has downsized. “In terms of [classic car] prices you could probably say the market has plateaued for now,” says Dietrich Hatlapa of HAGI.

Meanwhile, in 2020 the rare coin market is red hot. Numismatics offers you the best alternative store of value among tangible asset collectibles.

We are in the early stages of rare coin bull market

Remember, in 2001-2008 coin values went up by a lot. We are in the beginning of that phase now.

How do rare coins fit into your financial picture?

Blue-chip rare gold is the place to park your dollars right now.

Look for proof gold, early gold, early silver, branch mint gold, high reliefs, and world-class rarities. It’s a great strategy at the right time. Independent research confirms it. Professor Lombra’s data is solid, and the findings are very clear: allocate toward high-end rare coins. If you haven’t read the report, please read the details now.

Why you should consider blue chip rare gold now

Sadly, the decline of a once-great economic power is well underway. This pandemic has only increased the fall…

The government has killed the golden goose and, in an attempt to hide the obvious, it is devaluing the U.S. dollar, fast. This ultimately will lead to inflation.

It’s Economics 101.

Inflation is on the way. Right now, gold and rare coins are in the beginning of what could prove to be the strongest bull market for gold and rarities on record. In all likelihood, there are years of growth ahead in these markets.

The Great Inflation period from the 1970’s and early 1980’s shows us when inflation becomes institutionalized, collectibles that tend to appreciate in value the fastest are those that are portable and private – like numismatics.

In late 1970’s values of collectible stamps and coins rose at a rate of 20 percent a year on average.

Looking ahead, there is no end to future inflation in America. Our country has created a noose around our economy’s neck. The long-term outlook is for continued debasement of the U.S. dollar’s buying power.

To strategize for such a time, it becomes prudent for you to develop a game plan based upon solid information. We will say it again: blue-chip rare gold is the place to park your dollars right now.

If you need assistance identifying and sourcing coins, please call a Blanchard portfolio manager today. Inflation is a clear and present danger to our economy and your future wealth. Yet if you act now, you can protect your wealth in a proven asset class – numismatics. We are happy to answer any questions you may have and can guide you through the process to identify what coins are best suited to help you meet your long-term financial goals.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

What a Possible Biden Presidency Means for Silver

Posted on — Leave a commentThe potential win by Democrat Joe Biden ushers in a new era for government policies from taxes to trade to energy.

Indeed, Biden’s energy platform and priorities would look very different from Trump’s.

Silver is up 35% this year. Here’s why it could go even higher next year.

During his campaign, Biden released an ambitious green energy agenda, which if even partially enacted could unleash a new uptrend in the silver market. In recent months, Biden called for a “carbon pollution-free power sector by 2035.” A development like this would require a massive acceleration in renewable wind and solar power here in the United States.

If Biden makes it to the White House and gains traction on his goals to stem global warming, silver stands to gain.

Why? Silver is a key ingredient used in solar panels. Silver, which already traded at a 6-year high in 2020, could see new industrial demand in a green energy push – amid a tightening supply situation – which could send prices soaring.

Industrial demand for silver in solar panels is not a new trend. It’s been growing in recent years. For example, silver’s use in photovoltaics increased by 7% in 2019 and is forecast to continue to move higher as governments turn to renewable energy sources like solar.

Yet, an official move toward a wider use of solar power as imagined in Biden’s plan could double silver’s price, Peter Thomas, a senior vice president at Chicago-based broker Zaner Group told Bloomberg earlier this year.

Analysts at Bank of America echoed this outlook in a research note.

“Industrial demand ultimately moves the needle” for silver prices, according to a team analysts at Bank of America strategists led by Michael Widmer.

Silver has already surged over 60% this year hitting an August high over $28.00 an ounce as investors turned to the precious metal as a safe-haven.

Adding additional industrial demand for larger use of solar energy would catapult silver prices even higher.

$26.87 an ounce as investors flocked to the precious metal as an alternative store of value during the COVID-19 pandemic.

An increase in industrial applications of silver, however, would catapult prices even higher.

The bank forecast that annual silver demand – current at 2,285 tonnes could climb 87% over the next 15 years if the U.S. energy sector accelerated its move to renewable energy.

Bank of America analysts said “green stimulus” under a Biden presidency could drive silver to $35 an ounce in 2021. And, over the medium term, silver could take a run at the $50.00 an ounce level.

Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How a Potential Biden Win Might Impact Gold Investments

Posted on — Leave a comment It should first be noted that presidents, on their own, are largely unable to push the stock market in any specific direction. Consider a study from the Federal Reserve Board which determined that “neither risk nor return varies significantly across the presidential cycle.” Therefore, investors seeking clues about future investment performance over the next four years should widen their perspective beyond the president. They should consider the entire political sphere.

It should first be noted that presidents, on their own, are largely unable to push the stock market in any specific direction. Consider a study from the Federal Reserve Board which determined that “neither risk nor return varies significantly across the presidential cycle.” Therefore, investors seeking clues about future investment performance over the next four years should widen their perspective beyond the president. They should consider the entire political sphere.

If Biden is declared the winner, he will almost certainly need to work in cooperation with Republicans to accomplish change. At the moment it remains unclear who will control the Senate. However, if Republicans retain their control Biden will need to build consensus to drive change. This joint approach could easily slow or even pause future fiscal stimulus measures. The result would likely be strong for safe haven assets like gold.

Additionally, U.S. bond yields remain relatively low. In this environment the opportunity cost of holding gold drops. This relationship is important because it is one that is outside the president’s control for the most part, given that these decisions fall to Federal Reserve Chairman Jay Powell. Powell will retain his position until February of 2022. As a result, it is unlikely that we will see any meaningful change to the governments approach to interest rates any time soon.

Even if Biden is able to appoint a new person to the role, he may very well choose someone that represents a continuation of Powell’s approach. This outcome is evident in remarks from Jared Berstein, one of Biden’s key economic advisors, who explained that he is “hard pressed to find all the positive adjectives I can think of for Jay Powell’s job.”

Interest rates, however, are not the only factor likely to be supportive for gold investments over the next four years. Sweeping reforms like selective tax increases, and greater business regulation may temper growth across publically traded companies leading to a setting in which gold becomes a more favored investment in comparison to equities.

Finally, as the U.S. enters the cold winter months COVID-19 has continued to surge. In recent days, the country surpassed 10 million cases. Importantly, the rate of new cases is escalating. The U.S. now experiences an average of 100,000 new COVID-19 cases everyday. In short: America has suffered from more COVID-19 cases than any other country on the planet.

Unfortunately, this trend is unlikely to abate any time soon. The result could be lower consumer confidence, worsening business conditions, and diminished growth prospects for U.S. and global businesses. The pandemic continues to take a toll on investors and corporations. This environment has renewed interest in durable stores of wealth like commodities including gold. While there will be an eventual end there is almost certainly no improvement to be expected in the near-term.

Changes are afoot and many of them will leave gold investors well positioned for growth. A continuation of a low interest rate environment, tempered business growth, and a towering public health crisis all support gold investments for the long run.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Monday Morning Wrap Up – November 9, 2020

Posted on — Leave a commentGold Soars after Historic Election

It was a long week. No matter what side of the political aisle you sit, the markets have an important message for you. Here it is:

Investors want to own gold.

Indeed, as the election results became clear, gold soared over $100 an ounce over the past seven trading days. Spot gold recently traded above the $1,950 an ounce.

Yes, there could still be many more twists and turns on the political front ahead.

Here is what we know now.

The pollsters got it wrong. Again. Terribly wrong. There was no Biden blowout. No massive Blue Wave.

Nonetheless, at the end of a very long week, it became clear that Democratic contender Joe Biden earned 290 Electoral College votes – more than the 270 needed to win the presidency.

What’s next?

Trump has not conceded. He is casting a wide legal net to contest the results.

The Trump team is pursuing an aggressive legal strategy to dispute the vote with lawsuits in Michigan, a call for a recount in Wisconsin, and an attempt to invalidate ballots in Georgia and Pennsylvania.

Nancy Pelosi will control a smaller majority in the House of Representatives. Democrats lost at least 7 seats in last week’s battle.

Republicans will likely maintain control of the Senate. However, there are two run-off races that could sway the results. All eyes are now on Georgia with two open Senate seats that will go to a run-off race on January 5th.

Stock market embraces idea of divided government. The stock market climbed last week, rallying on expectations that our country will have a Republican Senate and a Biden presidency. Stock investors bought into the idea that divided government could mean no tax increases and a limit to curbs on the business regulatory environment.

We are in uncharted political territory.

Even though the election has been called for Joe Biden, many experts expect a period of uncertainty as votes are recounted and lawsuits begin to work their way through the courts.

The political situation remains combustible with potential for civil unrest. Over the weekend, Trump supporters amassed in the capitals of Pennsylvania and Michigan waving flags and signs claiming ballot fraud and blaming the media.

This period of uncertainty will be especially positive for gold as a safe-haven asset.

Looking ahead…

How to prepare your portfolio for the next four years.

A Biden presidency will mean more stimulus, larger federal deficits and more inflation. That is bullish for gold.

Soon, the stock market focus will return to the fast-spreading coronavirus and its impact on the economy. Expect this stock rally to be short-lived.

In fact, the COVID third wave in the United States continues to get worse. The U.S. set a new record high of 125,000 cases in one day last week. The U.S. is closing in fast on 10 million cases, with the count at 9.8 million on Sunday, according to Johns Hopkins University.

The Fed remains impotent.

While the Federal Reserve met last week, the central bank is out of bullets. Interest rates are at zero already. They left policy unchanged and have pledged to keep interest rates at zero percent for years.

The U.S. economy remains hostage to the coronavirus – and until the virus is under control, the economy can’t get back to normal.

The new president will indeed face many challenges. There will be no magic wand to instantly solve the health crisis, the high unemployment or the massive federal debt.

The money supply will continue to climb. And gold and silver will rise as investors yearn for tangible assets. Rare coins and precious metals are proven vehicles to store, preserve and grow wealth. While much uncertainty lies ahead, all the ingredients for massive inflation have already been baked into the economy. It is only a matter of time before inflation explodes higher.

Opportunity is knocking.

There are only 72 days before a new president is inaugurated.

Act now to prepare your portfolio with an increased investment in gold and silver to prepare for the next four years.

Until next week…

David

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How The Gold Dollar Emboldened National Identity

Posted on — Leave a commentAs the California gold rush introduced more gold into the economy the U.S. Congress resolved to design and issue a gold dollar. The decision, however, was not without detractors. The Mint director at the time, Robert Patterson, was opposed to the idea. When a bill was introduced to support the initiative, some argued that it would lead to problems like counterfeit currency, and confusion with other coins. Others, in favor of the idea, cited benefits. They advocated for the coins by explaining that they would enable currency circulation in small communities where banknotes were not used. The arguments prevailed and in 1849 the bill passed.

Chief Engraver James B. Longacre began work on the designs. He made the work of preparing the coin his singular mission. As an artist he wanted to own the entire process stating that he would “execute this work single handed.” The original piece was the profile of Liberty with a coronet with the word “Liberty” across the top. The design was simple, but elegant and earned largely positive reviews. The first production began in early May of 1849.

In time, the gold dollar rose in prominence. This outcome, however, was not due to the beauty of the design, but instead for more prosaic reasons relating to the rise of silver prices. As silver became more expensive more U.S. silver coins started to exit the country for melting. An imbalance started to occur as the value of the silver within coins was surpassing the face value of the pieces. Silver coins began to disappear and soon the gold dollar was the sole federal coin in circulation that filled the gap between the cent and the quarter eagle. These circumstances led to an increase in the minting of the gold dollar. Eventually, silver coins returned to circulation in 1853 when Congress allowed silver coins to be minted in smaller weights.

Later, the Type 2 (1854-1856) and the type 3 (1856-1889) $1 gold pieces featured Liberty as a Native American princess with a headdress in feathers. The look of these coins was inspired by the sculpture Venus Accroupie or Crouching Venus on display in Philadelphia.

Mintages eventually decreased as the 1850s passed and 1862 marked the last year in which production exceeded one million pieces. During the following year minting plummeted to less than 7,000 pieces. Over the lifetime of the coin’s minting the vast majority came from the Philadelphia Mint. Smaller portions of the total came from San Francisco, New Orleans, and Charlotte. Certain portions of the total issuance remain exceedingly rare today including the 1861-D coin of which only an estimated 1,000 were minted. Today, it is believed that no more than 60 are accounted for.

Today the coin remains a sought-after piece representing the fervor surrounding the California gold rush and the formative years of the nation’s currency system. The deep cameo finish is a powerful look that brings the beauty of the profile into contrast with the mirrored background.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The 1936 Columbia Silver Half Dollar Commemorative

Posted on — Leave a commentAn Early Southern Gem

After the end of the American Revolution, the state capital of South Carolina – Charleston at the time, was considered vulnerable to attack by sea, and also too far from the magnificent plantations and agricultural lands that were being developed throughout the state.

The South Carolina legislature took action.

In 1786, they named Columbia, alongside the Congaree River, the new state capital of South Carolina. This made Columbia one of the first planned cities in the country.

Fast forward 150 years.

In order to finance extensive celebrations of the 150th anniversary of the founding of Columbia in 1936, the Columbia Sesquicentennial Commission asked Congress for permission to strike commemorative coins. The Act of March 18th, 1936 authorized the striking of a commemorative silver half dollar. However, the celebration which took place March 22-29, 1936, began less than a week after the passage of the commemorative coin bill. That meant no silver half dollars would be on sale at the event for the fairgoers.

Indeed, this classic U.S. commemorative coin has a unique claim to fame. It was, in fact, the first commemorative coin to be authorized in 1936, but it was the last to be distributed.

The Sesquicentennial Commission chose a local artist – sculptor A. Wolfe Davidson from Colombia’s Clemson College to design the coin. Davidson’s initial designs were rejected by the committee, which held the coin to exceedingly high standards.

In the end, the Commission of Fine Arts collaborated with the artist to make major changes to the coin design before his models were finally approved in July 1936.

The coin design.

The obverse of the coin reveals a full figure of Justice. She is flanked on the left by the Old State House and on the right the new State House, with the years 1786 and 1936 etched below. The motto LIBERTY stands above the Old State House. The coin is encircled with the inscriptions: SESQUI CENTENNIAL CELEBRATION OF THE CAPITAL and COLUMBIA SOUTH CAROLINA.

The reverse symbolizes the strength of South Carolina’s native palmetto trees.

The state symbol – the palmetto tree dominates the reverse of the coin. The magnificent tree stands triumphantly above a broken limb of an oak. That symbolizes the rich history of the South Carolina’s strong palmetto trees – which formed the walls of Fort Moultrie in Charleston and held back gunfire of the British navy’s ships built from oak.

Around the tree, 13 stars are featured, highlighting South Carolina’s unique status as one of the original 13 colonies and states. The reverse is inscribed with E PLURIBUS UNUM, to its right IN GOD WE TRUST. The words UNITED STATES OF AMERICA and HALF DOLLAR encircle the coin.

Comprised of 90% silver and 10% copper only 9,007 of this gems were struck. These commemorative coins were apparently handled with care as many specimens have few marks or abrasions.

Monday Morning Wrap Up – November 2, 2020

Posted on — Leave a commentCountdown to Election Day.

In a watershed event, Americans will conclude their voting in the 2020 U.S. Presidential election this Tuesday evening. A record number of early voters have already voted. And, the clock is ticking before polls will close on Tuesday evening for good.

What’s at stake? The White House, 35 Senate seats and 435 House of Representative seats are on the line.

Election officials have widely broadcast that final tallies won’t likely be available on Tuesday evening in light of mail-in ballots used during the COVID-19 health crisis. Many states, by law, are unable to begin counting mail-in ballots until the polls close on Tuesday evening, which could mean final results may not be available for several days to a week.

Gold wins no matter which party controls the White House.

Looking ahead, we use history as a guide to forecast higher gold prices ahead no matter who wins the presidential election. In fact, gold’s performance has been roughly equal under both Democratic and Republican presidencies.

“Since 1971, gold returns were 11% on average per year during Democratic presidencies and 10% during Republican ones,” the World Gold Council said.

Stocks plunge – worst one week sell-off since March.

It was a rough week last week on Wall Street.

Rising COVID-19 cases and political uncertainty drove the S&P 500 down 5.6% in only 3 days.

As the virus rages across the world and expands aggressively in the United States, Wall Street investors pulled out of stocks. With hopes of an economic stimulus package on hold for the foreseeable future, the U.S. economy faces a bleak couple of months. Stock investors know this – and that’s why they are running for cover.

The second (or third) wave is here.

COVID cases hit new all-time highs here in the U.S. last week as the health crisis expands unabated.

Several countries across Europe were forced to lock down as the virus spread again there. France made global headlines after announcing a nationwide stay-at-home order in response to the surging COVID cases and hospitalization rates there.

GDP data mostly a wash.

Gross domestic product data last week revealed the U.S. economy grew 33.1% in the third quarter.

So what.

That comes after falling 31.4% in the second quarter. The third quarter gains can largely be chalked up to the economy reopening after the spring shelter-in-place orders and the massive emergency stimulus measures passed by Congress. That stimulus money has run out. The economy must now hobble along on its own going forward.

Fed meets this week.

The Federal Reserve meets after the election this week. Expect the central bank to take a backseat to the election results, or ongoing election wrangling. There are no changes expected to the Fed’s zero interest rate policy. The Fed is “all-in” on juicing the economy with zero interest rates and massive money printing. It has already set the stage for future inflation here in the U.S. with its unprecedented actions this year – and no matter what it does going forward it will be difficult to put that genie back into the bottle.

Many black clouds on the horizon.

No matter who wins the White House, that will not instantly erase the COVID pandemic, the economic challenges, the high rate of joblessness, the historic levels of U.S. government debt, and a politically divided nation.

Whoever wins the White House will face perhaps the greatest challenges of a U.S. President ever.

In the midst of these crises on multiple fronts, what’s the world’s favorite safe haven? Gold.

Yes, gold and silver are posting double digit gains in 2020 amid market volatility, political strife, economic recession, joblessness and the worst health crisis in 100 years. Bank of America projects gold to climb to $3,000 an ounce in the months ahead.

Precious metals are acting as a haven in the current economic and political storm. No matter what happens this week, the country still faces incredible challenges ahead and the historic bull market in precious metals is just getting started. You can take that to the vault.

Until next week.

Regards,

David

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How ESG Initiatives Will Drive the Future of Gold Investing

Posted on — 1 CommentThe importance of environmental, social, and governance (ESG) issues to investors is playing an out-sized role in decision-making today. More individuals and businesses are trying to understand how their actions will impact others. An example of this phenomenon can be found in one of the least expected places: a colony of 25 rare chinchillas.

The short-haired chinchilla is an endangered species after being hunted to the brink of extinction. However, what makes this particular colony of rodents especially valuable is not just their endangered status, it’s what sits below the ground they inhabit. The colony is atop 3.5 million ounces of gold in the Salares Norte open pit mine in Chile.

Today, the mine is still in the permitting phase. The project, headed by the South African Gold Fields company, represents an $860 million investment. To move forward the project is obligated by Chilean law to relocate each of the 25 chinchillas. The latest reported figures show that Gold Fields has spent approximately $400,000 in an attempt to safely trap the animals. The expense illustrates that capturing the chinchillas and relocating them is harder than it sounds.

Chilean environmental manager Luis Ortega explains that two, non-lethal, attempts must be made to capture each rodent and each can last for a maximum of 10 days. If unsuccessful, the mining company must pause their efforts for 20 days before trying again.

Abiding by these regulations before mining begins is more than a legal requirement, it is also characteristic of business today. Consider research from FTSE Russel which found that a little over half of investors globally are implementing or evaluating ESG characteristics in their investment decisions. These investors are driven by more than a sense of responsibility to society and the planet. They are also driven by the search for annual returns.

Studies show that ESG investing strategies offer a long-term growth advantage. “Investing in sustainability has usually met, and often exceeded, the performance of comparable traditional investments,” concludes research from The Morgan Stanley Institute for Sustainable Investing. This finding makes intuitive sense because businesses that focus on sustainability prioritize renewable resources and a reduction in waste. Both of these practices reduce expenses in the long run which, in turn, improve profitability.

Another study from Harvard concluded that investing $1 in an equally weighted portfolio consisting only of high sustainability firms at the start of 1993 to the end of 2010 would out earn the same investment in a non-ESG portfolio by 46 percent.

The Gold Fields chinchilla project illustrates that gold mining operations can also abide by ESG standards. What makes ESG investing so powerful is the confluence of environmentalism, efficiency, and ethos. Businesses become more responsible to the planet while benefiting from improved use of resources while fulfilling investors’ growing need for ethics in their portfolio.

The World Gold Council has codified this movement with their “Responsible Gold Mining Principles,” which is a list of ten characteristics that, as a whole, represent responsible gold mining. These principles include things like safety and health, human rights and conflict, and working with communities. ESG-driven plans are a rare instance in which all parties benefit.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

“What Happens If…” New Supreme Court Justice Amy Coney Barrett Rules on Election Challenges

Posted on — 1 CommentWill Supreme Court Rescue Trump Presidency?

A global pandemic, wrenching unemployment and political polarization have created one of the most uncertain presidential election environments in modern history.

In late October, polls show the presidential race tightening between President Trump and Democratic nominee Biden. The president has been casting doubt over mail-in ballots for weeks and the Republicans have been busily filing hundreds of lawsuits across the country designed to limit how mail-in ballots can be counted.

Issues like postmarks, when the ballot arrives, does the signature match, did the voter fill out the ballot correctly or did the voter move recently are all items being contested in court now – ahead of the election.

In our final election series installment we outline a potential legal battle over the results.

It’s November 4th: Day after Election

Wednesday morning November 4th, U.S. citizens wake up to the news that neither candidate yet has the required 270 Electoral College votes to determine a winner.

Thousands and thousands of mail-in ballots are still being processed and counted. In several key states across the country, mail-in ballots cannot be processed (verified) and then counted until after the polls close.

Local election systems are overwhelmed with the huge number of mail-in ballots used in 2020 due to the COVID health crisis and are working slowly through the ballots.

Supreme Court in Focus

Assuming that Amy Coney Barrett will be seated on the Supreme Court before the November 3rd presidential election – she will become the key and deciding vote in a case on mail-in ballots and who, ultimately, will become the United States President for the next four years.

A 4-4 Split Means Lower Court’s Ruling is Upheld

Without a ninth justice on the Supreme Court (which Barret will be) – any 4-4 Supreme Court ties — revert to the decision of the lower court. Let’s unpack what that means.

For example, in mid-October, the Supreme Court already ruled on a case regarding Pennsylvania state mail-in ballots.

A Pennsylvania state court ruled that mail-in ballots could be counted even if they arrive up to 3 days after election day – if they are postmarked by election day. The Supreme Court ruled in a 4-4 tie on the matter.

That means the decision of the lower Pennsylvania court stands – and those mail-in ballots can be counted.

If Amy Coney Barret had been on the court at that time, her judicial philosophy suggests she would have joined with the 4 conservative votes to not allow those votes to be counted. And, the lower court’s ruling would have been struck down.

2020 Trump v. Biden

So, you can see when it comes to election cases – having a fifth reliable conservative vote on the court could make the difference between a Joe Biden presidency and a Donald Trump second term.

Barrett dodged recusal questions

It’s no secret why President Trump wanted to advance his judge so quickly.

Amy Coney Barrett has been thrust onto the court amid President Trump’s frank calls for her swift confirmation so that she can be seated in time to decide the election cases.

Yet, in her Congressional testimony, Barrett artfully declined to answer whether or not she would recuse herself if a contested election case comes before her that could determine the outcome of this monumental presidential election.

Indeed, legal scholars point to a case from over a decade ago – Caperton v. A.T. Massey Coal Co., and say it applies directly to Barrett’s recusal decision and would require her to decline to vote on election cases.

The case states: A judge cannot hear a case that centers on the financial interests of someone who supported him substantially in his campaign for election.

Here’s the rationale: “Under the Due Process Clause and Tumey v. Ohio (1927), a judge must recuse himself if he has a direct, personal, substantial, pecuniary interest in the outcome of a case.”

Even more, Justice Antonin Scalia, while he did dissent in the case he wrote in that case: “In the best of all possible worlds, [judges should] sometimes recuse [themselves] even where the clear commands” of the Constitution don’t require it.

Yes, there is a strong case for Amy Coney Barrett to recuse herself from 2020 election cases.

Will she recuse herself?

Unlikely.

Get Ready for a Replay of 2020: Bush v. Gore

The nation has been primed for and is hurtling toward a reply of 2020’s Bush v. Gore, in which the Supreme Court decided the fate of the election and the country for the next four years.

President Trump stated shortly after the death of Supreme Court Justice Ruth Bader Ginsberg: “I think this [election decision] will end up in the Supreme Court,” “And I think it’s very important that we have nine justices,” instead of the eight seats currently filled.

President Trump publicly stated several times that he wants Barrett to be appointed swiftly so she will be on the court in time to “decide” the presidential election results.

How Will Financial Markets Respond?

In the event that our country moves through November and December with no presidential outcome – as court cases work their way toward the Supreme Court – the stock market will sink.

In 2000, the last time we saw a contested presidential election, the S&P 500 and technology stocks sank. Expect that to happen again – extended stock market weakness and volatility. In this scenario, investors will rush to safe haven assets like gold and silver and the U.S. dollar will tumble by 15-20%. Gold climb moderately amid the uncertainty hitting a new all-time high at $2,100 an ounce.

Bottom line

If the 2020 Presidential election battle is turned over to the courts as it was in 2000 – having Amy Coney Barrett seated on the court all but ensures a victory for incumbent President Trump.

Worth noting – power to pick presidents and strike down laws

No matter your political party affiliation, it is worth noting the extreme power the Supreme Court now has on our society.

In an increasingly polarized environment where Congress has become ineffectual due to gridlock, the Supreme Court has moved to the forefront to be the most important governing body in our land.

Of course, our founding fathers intended for all three branches of government (Executive, Judicial and Congress) to be equal with checks and balances on each other.

Today’s reality is different.

The Supreme Court has shown its ability to decide presidential elections (Bush in 2000) and can strike down any law that Congress passes that it sees unconstitutional.

With a strong conservative majority on the Supreme Court with Amy Coney Barrett – and their lifetime appointments – the Supreme Court has become the most powerful influence and governing body for America for the next 30 years.

Longer-Term Market View

In this scenario, once the Supreme Court decides the election – and hands the White House back to President Trump for a second term, U.S. dollar devaluation will continue as the Administration brow beats the Federal Reserve into printing ever more money to attempt to prop up the economy.

The stock market will rally briefly on expectations for another tax cut – but as the second term continues the economic realities of isolationist and combative trade policies tank the U.S. equity market.

Investors will turn to hard assets like gold and silver as the dollar continues to weaken and as capital begins to leave the United States.

Wealthy investors will begin to move their money offshore as it becomes clear the decline of the United States of America is on a track that can’t be turned around. Gold will easily eclipse the $3,000 an ounce mark. For precious metals investors, there is small comfort in their gold and silver holdings, as inflation is becoming rampant and the country’s economic future becomes grimmer.

This concludes our “What Happens If…” election series. With less than one week until election day, we hope that we’ve provided you with valuable information to help you prepare your portfolio for most any eventuality.

Regardless of the election outcome, the economy is still reeling from the pandemic and a quick recovery is unlikely. Inflation is coming. Call us today at 866-629-2281 for a personalized review of your long-term financial goals. We want to help you protect what you’ve worked hard to build.

If you’d like to read the entire six-week series, please follow the links below and let us know your thoughts.

Read Part 1 here: “What happens if….” Trump Wins in a Landslide

Read Part 2 here: “What Happens If….Biden Wins in a Landslide

Read Part 5 here: What Happens If…” States Aren’t Ready to Declare a Winner