Three Truths, And a Lie About Gold

Posted on — Leave a commentInvestors sometimes hesitate when contemplating a gold purchase. They are unsure of about taking the next step because they find commodities confusing. This uncertainty is understandable. Gold is nebulous. It doesn’t trace back to a product, service, or a board of directors.

In contrast, stocks and bonds are less opaque. They are the life blood of one of the most American of institutions: the corporation. People understand the basic idea of these two asset classes. With stocks you are becoming an owner of a company. With bonds you are becoming a lender to a company.

For too long, people have complicated gold investing by making false, or needlessly complex statements about the precious metal. Here, with the help of research from The World Gold Council, we dispel some of those myths by discussing the three key truths of gold, and one major misconception.

Truth: Gold is Less Volatile Than Other Commodities

Gold is more stable than a host of other commodities. The metal’s annual volatility is well below that of silver, platinum, and several commodity indexes like the Bloomberg Oil Index, the Bloomberg Energy Index, the Bloomberg Industrial Index, and even the S&P GS Commodity Index. Over the past 10 years, gold has been more stable than all of theses other commodities and indices.

Truth: Gold Delivers in High Inflation Environments

Between 1971 and 2018 gold has delivered an average annual nominal return of approximately 15% during periods of high inflation (>3%). What makes this performance so impressive is the fact that it outpaces the nominal average annual return of the Bloomberg Commodity Index over the same period. Even more impressive is the fact that in low inflation environments (<3%) gold still generates a positive return of approximately 5% while the commodities dip into negative territory.

Truth: Gold Behaves Differently Than Other Commodities

Gold is often discussed in investment literature as a commodity. While it is true that gold is a commodity, it is also misleading to discuss the precious metal as if it behaves like all commodities. Consider that gold tends to generate positive performance when volatility increases. For example, during the Great Recession, the Bloomberg Commodity Index lost more than a quarter of its value whereas gold delivered a return just shy of 50%. This same relationship occurred during the second Sovereign Debt Crisis in 2011 when the Commodity Index fell into negative return territory while gold delivered more than 25%.

Lie: Stocks Outperform Gold Over the Long Run

Of all the untrue statements about gold, this one is perhaps the most pervasive and harmful to investors. Over the past 20 years, gold has outperformed many different equity configurations including US stocks and EAFE stocks. In fact, gold has also outperformed the US Bond Aggregate, US cash, and the Bloomberg Commodity Index over the same period. Moreover, even when we extend this time line to the last 48 years we see that US stocks and EAFE stocks only narrowly outperform gold. It is also worth mentioning that this out-performance comes at the cost of increased volatility compared to gold.

Getting it right as an investor means getting the facts and nothing speaks louder, or truer, than data. Take these three truths (and this one lie) as a starting point to explore how gold really helps a portfolio over the long run.

Why Your Tangible Assets Portfolio Should Include Rare Coins

Posted on — Leave a commentIt’s commonly know that gold is a great hedge against inflation and a proven portfolio diversifier.

What isn’t commonly known is that investments in U.S. rare coins do an even better job at growing your long-term investment returns.

In fact, the investment return on U.S. rare coins over the last 40 years is higher than other assets and TWICE THAT OF GOLD, according to an independent study by Raymond E. Lombra, Ph.D., entitled The Investment Performance of U.S. Rare Coins.

Current Environment Means Investors Need to be Proactive

Heading into the final quarter of 2019, we identify rising macro risks for investors. Here are just five of the risks that dominate the horizon as we cast our eyes into 2020.

-

Liquidity Crisis: A cash crunch in the repo market starting in mid-September triggered a new round of quantitative easing by the Federal Reserve, through its daily injections of cash into the overnight market. The last time we saw actions like this? Right before the housing crash of 2007, which preceded the Great Recession.

-

Negative Interest Rates: In a desperate attempt to stimulate economic growth, some developed countries have implemented so-called negative interest rates. Some central banks have turned to this untried “negative interest rate” policy method, which allows rates to fall below zero. Yes, that means you have to pay your bank to hold your savings. Countries that have, or had negative interest rates include the Euro area, Switzerland, Denmark, Sweden and Japan.

-

U.S. – China Trade War: Recent economic data confirms that the trade war is beginning to slow U.S. and global economic growth.

-

Stock Market Volatility: The 10-year old bull market in stocks is on its last legs. Increased volatility is a warning signal that a top could be forming now. In the first nine days of October, the S&P 500 registered four daily price swings of 1% or more.

-

Trump Impeachment Inquiry: Political risks are rising with the Democratic impeachment inquiry and a presidential election in 2020.

Investment Recommendations for Third Quarter

We recommend investors take proactive steps to protect and grow wealth in the face of rising market uncertainty. There are simple steps you can easily take to play defense right now.

Past performance can give us clues about the future.

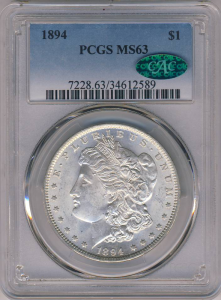

The appeal of rare coins is their impressive historical price appreciation, which has outpaced gold’s returns. Penn State University Professor Raymond Lombra conducted an independent study on the investment performance of U.S. rare coins from January 1979 to December 2016. He found that coins rated MS-65 nearly doubled the performance return of gold over that time.

| Average Annual % Returns 1979-2018 |

|

|---|---|

| Stocks | 12.4% |

| Treasury Bonds | 7.7% |

| Gold Bullion | 5.2% |

| Coins (all types – MS65) | 10.3% |

| Coins (all types – MS63-65) | 8.8% |

Key Takeaway

That data shows if you converted a portion of your gold bullion holdings into rare coins you could double your investment returns on tangible assets over the next two to three years.

Digging into the data, rare coins and gold outperformed Treasury Bonds through numerous business and market cycles.

-

Dr. Lombra found that annual gold returns were positive in twelve of the past fifteen years.

-

Rare coin returns were positive in thirteen of the last fifteen years.

-

Lombra concluded that over the long run, including rare U.S. coins within an existing portfolio could improve investment performance.

Getting Started Is Easy

Take these steps now to reduce portfolio volatility and protect and grow your wealth during the next economic recession and bear market in stocks.

-

Increase your overall exposure to tangible assets. Experts recommend up to 15-25% depending on your risk tolerance levels.

-

Add exposure to U.S. rare coins at the MS65 level or better.

-

Consider converting some of your current gold bullion holdings (likely at a nice profit) into rare coin holdings, which should outperform in the new gold bull market cycle that is just beginning now.

If the U.S. moves back to a zero-interest rate environment like it did during the 2009-2009 global financial crisis or even goes negative, or the stock market crashes, you can expect new all-time highs in gold above the $1,900 an ounce level. Many on Wall Street are already forecasting gold gains to the $2,000 an ounce level.

Just imagine what that will do to the U.S. rare coin market!

If history shows that U.S. rare coins gain twice as much as gold, investments in numismatics could easily double in 2020 and 2021 from current levels.

Incorporating defensive strategies like converting gold bullion into numismatics investments could be a way to more than double your investment return in tangible assets over the next two to three years. A Blanchard portfolio manager can help you develop a personalized investment plan when you call today at 1-800-880-4653.

What Does the Repo Market Drama Mean For You?

Posted on — Leave a commentAttention passengers, the pilot has turned on the seat belt sign. There is turbulence ahead. The latest drama in the repo market may be a wake-up call that all is not right in the banking system.

The repo market, a little-talked about corner of the U.S. financial system has been making headlines in recent weeks. Even if you’ve never heard of the repo market before, this latest news could be a warning signal that the house of cards is about to crumble.

The repo market officially stands for the repurchase market. That is an overnight lending market where banks make short-term loans to each other.

Running short on cash for the day? Banks can borrow money in the overnight market and pay it back the next day, usually at a very low interest rate around the Fed’s benchmark rate of 1.75%-2.00%.

At least that is the way it is supposed to work.

In mid-September, repo rates surged to 10%. The party line is that big demand for cash came as U.S. companies were squeezed as they needed to pay their corporate tax bills, which drained available liquidity from the financial markets.

Wondering when the last time this happened? Yep, you guessed it. Right before the housing market crash in 2007 and the Great Recession that followed.

Buckle up those seat belts, the ride could get bumpy ahead.

The Federal Reserve stepped in as the lender of last resort and has pumped over $300 billion into the overnight lending markets in just one month since mid-September.

Compare that number to $800 billion – or the size of the Fed’s balance sheet before the 2008 Global Financial Crisis.

What’s happened over the last month is BIG.

Private financial markets need public support and the Fed is trying to be the knight on a white horse.

Can it work?

The Fed announced last week that it will purchase $60 billion of Treasury bills a month starting in October. This will continue “at least into the second quarter of next year” to maintain ample reserves. Only time will tell.

What’s really worrisome is that this is the first time in 10 years the Fed has intervened in the repo markets. What would happen if the Fed didn’t step in and lend to these banks? Another bank failure?

The bankruptcy filing of Lehman Brothers in September 2008 was the domino that triggered the Great Recession and a huge bear market in stocks.

When the stock market is churning out double digit gains it is all too easy to forget what happened 10 years ago.

During the last bear market in 2007-2009, the S&P 500 lost approximately 50% of its value.

That hurts.

If you haven’t fully protected your portfolio with tangible assets like gold, take action now before it is too late.

Average savings accounts at banks are about 0.05%.

You aren’t even keeping pace with inflation at that rate. Why keep your funds in a banking system that is already showing cracks at the edges. Or, why keep your funds fully invested in a stock market that could turn on a dime. We’ve had a great run in stocks, but the cycle is overdue for a drop.

The question to ask yourself now: do you want a guarantee that you’ll get your money back?

If yes, move your cash out of a banking system with little to no interest or out of the stock market that is just begging for an excuse to drop.

Get peace of mind with a safe haven investment in gold. You can trust your investment in tangible assets will hold and grow its value no matter what happens at the bank down the block or to the stock market next month.

The Tumultuous Times of the 1861 Indian Princess Gold Coin

Posted on — 1 CommentIn the wild days of the California gold rush (1848-1855) the supply of gold surged in the US. This influx reinvigorated Congress’s interest in producing a gold coin dollar. Originally, the idea to issue a one-dollar gold coin came from Alexander Hamilton, the Secretary of the Treasury.

For a long time, government officials, and the US public, advocated for such a coin. Their argument was that issuing a one-dollar gold coin would be convenient in lieu of higher denomination pieces already in circulation. The government made formal moves to make this happen with legislation calling for the minting process to begin. However, the provisions for the coin were removed from the Mint Act of 1837 leaving the initiative languishing. The $10 eagle gold coin was already in circulation and cited by some as a sufficient, existing alternative. However, the denomination didn’t suit everyone’s needs.

Despite this, concerns persisted. Some officials worried that a one-dollar gold coin would incite counterfeiting. Others warned that such a coin might cause confusion in the event that people mistook it for a similar sized half dime.

Eventually, the few dissenting voices faded, and the bill became law in March of 1849. Soon after, Chief Engraver James B. Longacre began his design. Originally the coin featured the head of Liberty surrounded by lettering reading “United States of America.” The same lettering appeared on the obverse with a “1” in the center surrounded by a wreath of olive branches. The composition was 90% gold, and 10% copper.

The original design became known as the “Type 1.” Later, the Type 2 was minted from 1854 to 1856. The reason for the redesign was pragmatic; the high relief design created problems at some of the mints. Longacre altered the head of Liberty and designed her as a Native American Princess wearing a headdress. Longacre also pushed the lettering on the obverse closer to the rim. Together these changes made the imagery sharper and improved the efficiency of the minting process solving the problems of the Type 2. This version of the coin was minted from 1859 to 1889.

However, as the Civil War drew near the volume of the coins minted began to fall. Originally the US minted approximately two million pieces per year. That number fell to about 50,000 per year by 1860. By 1861, when the Civil War began, the US only minted an estimated 1,000 gold dollar coins at Georgia’s Dahlonega mint. These pieces have a “D” marking to signify their origin.

These pieces are especially rare for several reasons. First, the dies used came from Philadelphia. Therefore, they had already experienced significant wear and were only used for a limited period before they cracked and were discarded. Second, those dies arrived in Georgia just days before the state decided to succeed from the Union. As a result, the state’s thinning resources meant that mining operations were likely limited. Third, by the second half of 1861 all dies and coins held at the mint in Dahlonega became property of the treasury of the Confederate States of America. Eventually, many of the 1861-D coins were melted.

Today, the pieces are coveted by collectors seeking to own a coin stamped during one of the most pivotal times in our history. In time the coin was abolished but its value endures.

Game of Thrones Coin: Mithradates VI Stater

Posted on — Leave a commentWell … almost. Here, see what we mean:

Matricide.

Fratricide.

Filicide.

The slaughter of an entire Roman province of 80,000.

Who would do such things? Sounds like a villain out of Game of Thrones, right? Unfortunately, these acts are all too real. They were committed by King Mithridates IV, ruler of the Kingdom of Pontus.

Mithridates was loved by his people as their savior from Rome’s oppression. Rome, on the other hand, hated him as their most formidable enemy since Hannibal. For 26 glorious years, Mithridates evaded capture, immunized himself against poison by regularly consuming small doses, and won battle after battle against Rome.

His end came when his son led a rebellion against him and Pompey the Great defeated him in battle. But when Mithridates tried to commit suicide by drinking poison, his immunity worked … so he was killed by his foes instead.

You might not want to meet Mithridates in real life, but how does a coin from his rule sound? The coin’s reverse shows Athena sitting on a throne, while the obverse features a portrait of the deified Alexander, whose cloak Mithridates used to wear.

This gold stater dates from before the time of Christ: a true piece of antiquity to add to your collection now.

A Shipwreck for the Ages: The S.S. Central America

Posted on — Leave a commentThe siren song of gold called from California to every corner of the country. Across the nation, men (and a much smaller number of women) sold their possessions, borrowed money, and spent their savings to get themselves to the Promised Land. The journey, however, was perilous. Prospective gold miners, called ’49ers for the year (1849) that the Gold Rush started, traveled overland across mountain ranges, sailed to Panama, and sailed around Cape Horn – all to reach California.

Just as dangerous in some ways was the trip from California to the East Coast. One ship that regularly made that journey was the S.S. Central America, a 280-foot, wooden-hulled steamer. Launched in 1853, the steamer operated continuously on the Atlantic leg of the San Francisco–New York Panama route.

In September 1857, the S.S. Central America, laden with passengers and 2 tons of gold and coins from San Francisco, sank in a hurricane off the coast of the Carolinas. 425 people perished, and the loss of the wealth contributed to the Panic of 1857, a depression felt around the world.

The Maritime Bounty is Discovered

For 131 years, the precious cargo lay nestled at the bottom of the sea, presumed lost forever. In 1988, a team using a remotely operated vehicle discovered the ship 160 miles off the coast at a depth of 7,200 feet. Gold estimated to be worth $100–150 million was recovered. Recovery lasted 4 years and covered about 5% of the shipwreck site.

The excitement didn’t stop there: The founder of the discovery company became embroiled in legal battles related to the shipwreck, and he and his assistant went on the lam in 2012. The fugitives were found by U.S. Marshals and extradited to Ohio in 2015.

In 2014, a deep-ocean exploration firm began archaeological recovery of the ship. They discovered gold coins, nuggets, ingots, and dust. The coins included foreign gold and territorials as well as $20 Double Eagles, $10, $5, $2.50, and $1 gold coins. The coins date 1823–1857, with one scientist calling the hoard a “time capsule” of all coins in use in 1857.

Some standout coins from the S.S. Central America include $20 Liberty Double Eagle gold coins. The Liberty Double Eagle was authorized by Congress in response to the California Gold Rush, and was then minted for over 50 years. The obverse features a classic Greek Lady Liberty in profile wearing a crown bearing the word LIBERTY. The reverse shows a heraldic eagle holding a shield, an olive branch and arrows clutched in his talons.

In the first year, 1850, that the Liberty Double Eagle was minted, 1.1 million coins were produced. After that, far fewer were minted, and the Civil War also dramatically impacted their production. These coins are less frequently found than the Saint-Gaudens Double Eagles that replaced them in 1907.

Coins recovered from shipwrecks are renowned for several qualities. Firstly, they are rare. Of the thousands of ships that have sunk, few are recovered, and far fewer still have viable coins aboard. Secondly, shipwreck coins are rare historical artifacts, a glimpse into America’s past. And finally, many shipwreck coins have retained their details, luster, and full strikes, making them prized by collectors.

If you have a chance to get your hands on an S.S. Central America Liberty Double Eagle, consider it the opportunity of a lifetime. Life Magazine called the shipwreck’s bounty “…the greatest treasure ever found”.

If you’d like to read more about rare coins, market news and the latest on tangible assets, sign up for our newsletter!

Over 270 Million of These Coins Were Melted

Posted on — 2 CommentsOver 270 million Morgan silver dollars met their fate in the melting pot under the provisions of the Pittman Act of 1918.

The U.S. government ordered this dramatic move to save Great Britain from a banking collapse and may have also helped the Allies win the war.

How did this great silver meltdown come to pass?

Back then, international trade was conducted in gold.

Allies were buying steel, food and supplies to maintain their massive armies and paying in gold bullion. Gold became scarce. Hoarding was popular as the price was rising and exceeded face value of the coins. Great Britain resorted to silver certificates to pay for goods from India, its colony at the time, which was a major contributor to the war effort.

However, Great Britain had a silver problem. Germany began spreading rumors that Britain did not have enough silver to back the paper certificates it was using to buy war supplies, which many think was actually true!

Fortunately, for the war effort, America had a lot of silver dollars. At that time in the United States, of course, silver dollars could be redeemed by any citizen at any time for a silver certificate.

Senator Key Pittman of Nevada proposed legislation – the Pittman Act – and the United States came to the rescue. Passed on April 22, 1918, the Pittman Act authorized the melting of up to 350 million silver dollars – which could be sold to Britain for one dollar per ounce of bullion.

Millions of Morgan silver dollars were melted down in 1918 and shipped to England to avert crisis.

Britain honored its silver certificates and the U.S. silver sale helped prevent a banking collapse, riots in India over non-payment and helped keep the Allies flush with the money they needed to win the war.

Morgan silver dollars were first minted in 1878. The Morgan silver dollar was last minted in 1921 when it was replaced with the silver Peace dollar.

Collecting Morgans

Over 270 million Morgans are gone forever, lost to the melting pot. The dramatic history and significance of those remaining are what keeps collector interest high.

No good records were kept about which mintages were melted down, which has resulted in some surprises over the years.

Some of notable interest are Carson City Morgan silver dollars minted from 1880 through 1885. Why did so many survive? The answer is simple. When Carson City stopped producing coins, the Morgans were shipped back East and ended up in the back of the U.S. Treasury vault. During the great silver meltdown, coins were simply taken from the front and middle of the vault until no more were needed. The Carson City coins escaped melting pot since they were in the back of the vault!

Just getting started? Collectors often covet both the first and last year Morgan dollars – 1878 and 1921 – as they represent the beginning and end of this highly desirable coin series.

Do you have any Morgan silver dollars? Leave a comment below.

Want to read more? Sign up for our newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The 1907 High-Relief Saint-Gaudens: A miniature sculpture in your hands

Posted on — Leave a commentWhen President Theodore Roosevelt set his mind on something, nothing would hold him back.

And one thing he wanted was to improve America’s image in the world. As part of that mission, he decided to send a fleet of battleships around the world to show how powerful our navy was.

However, there was one problem: “I think the state of our coinage is artistically of atrocious hideousness,” President Roosevelt wrote to the Secretary of the Treasury. In fact, he believed that no coins in the previous 2,000 years had surpassed the beauty and relief of the coins of Alexander the Great’s era.

President Roosevelt wanted beautiful coins to represent America on the fleet’s international tour, so he recruited renowned sculptor Augustus Saint-Gaudens to create a new Double Eagle design—one with high relief like ancient Greek coins.

The Double Eagle quickly ran into some roadblocks. Mint officials were concerned that raising the coin’s figures to the height of the ancient Greek coins would make them unstackable—a necessity for modern banking houses. In striking, the high relief was also a problem: multiple blows from a hydraulic press were required to fully form the coin, greatly adding to the coin’s production time.

The motifs were thus flattened for general production, making the high-relief coins rarer and far superior in the eyes of collectors ever since. Compared to one of the flattened coins, a high-relief Double Eagle is like holding a miniature sculpture in your hand.

Two types of edges were used in creating the high-relief Double Eagle: wire edge and flat edge. The flat-edge variety was created by adjusting the pressure of the mint presses at the end of production, which caused them to be two to three times rarer than the wire-edge variety.

Whichever variety you choose, you’ll be getting a coin struck in beautiful “HD”—all high reliefs were struck at least three to five times.

The 1715 Spanish Treasure Fleet: A Coin from the Watery Depths

Posted on — Leave a commentThe men had just had two days of calm seas. But it wasn’t to last …

A strange swell appeared in the sea, silent and unsettling. The sea birds vanished.

The swell grew; cargo rolled in the holds; and for the 1,000 men sailing the 11 ships of Spain’s Treasure Fleet, the night passed uneasily.

In the morning, the sun never seemed to rise. By noon, visibility was so poor that the convoy of ships lit lamps to guide each other. In the afternoon, the wind came; and by nightfall, a hurricane had struck.

The fleet scattered, each ship alone in the screaming wind. And then the sailors saw them: the breakers on the coral reefs that line the Florida Coast. The men started to pray. The priests started to say Hail Marys.

And then the first ship hit the reefs.

Only a few men survived that night, and it’s from them that we have this tale.

In the morning, wreckage and bodies were scattered across 30 miles of uninhabited coast—and the search for treasure began. For the next four years, the Spanish braved sharks, barracudas, and buccaneers to salvage what they could of the treasure, but a hoard’s worth of millions still remained.

There it remained, for centuries, until modern-day treasure hunters found it.

Today that treasure is a time capsule from a bygone era: a time when pirates roamed the seas, and the might of the Spanish Empire spread far and wide.

Today we bring a coin from that time: an 8 Escudo, minted between 1691 and 1700. The 8 Escudo is the crown jewel of all the 1715 Treasure Fleet escudos. It features the Pillars of Hercules above waves, symbolizing Spain’s portal from the Mediterranean to the Atlantic and the wider world. The other side displays a cross, the arms of Castile (castles), and the arms of Leon (lions). Together, this magnificent design represents colonial Spain’s dominion over land and sea.

This coin was struck and trimmed by hand, the magnificent handiwork of an eighteenth-century minter. Gold is impervious to saltwater, so this coin has remained in fine condition.

Want to read more great rare coin stories? Sign up for our newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

What Does an Oil Price Spike Mean for Gold?

Posted on — Leave a commentJust days ago, a group attacked the Saudi Arabian Abqaiq oil facility. The location outputs 5 million barrels of crude oil every day. This volume represents 5% of the global oil supply. The attacks disrupted their production sending oil prices north by about 10% marking the largest one-day increase ever seen in the oil industry. Amazingly, the response from gold was muted.

This minimal movement is surprising because history shows that gold reacts violently to oil price changes. For example, the 1973-74 OPEC embargo disrupted 7.5% of the global supply of oil and as a result the price of gold surged 65%.

A few years later the Iranian Revolution from 1978-1979 interrupted global production and oil jumped 119% in price which sent gold surging by 163%.

This quick look back on previous oil price spikes begs the question, why hasn’t gold increased in price?

Amin Nasser, Aramco’s CEO, has made clear that the damaged facility is still able to produce approximately 2 million barrels of oil per day. Moreover, current projections indicate that output will return to their original levels by the end of this month. Perhaps gold is taking its pricing cues from this news. In other words, gold may be consolidating, but what does that mean?

Consolidation, in the context of investing, means that an asset is neither increasing nor decreasing in price. Assets that are consolidating experience a narrow range of price fluctuations and this may be what we’re seeing with gold. That is, the asset is simply holding steady as the global picture comes into focus.

Another possibility for limited gold price movement despite such substantial oil price fluctuations is that investors view oil as less of a concern than before. They may be onto something. Consider that the weight of oil and gas stocks in the S&P 500 is at its lowest point since 1979. This development has been seen by some as a signal of a future in which the world economy is less reliant on oil.

Recently, Jeff Bezos announced that 80% of Amazon will be running on renewable energy as early as 2024. Similarly, Google announced that it will make a record-breaking $2 billion investment in renewable energy projects.

Perhaps the biggest indication of oil’s waning significance is that over the past five years 30% of the returns generated by the S&P 500 came from just five companies, all of which are technology titans (Amazon, Facebook, Netflix, Alphabet, and Apple).

As one utilities analyst at Morningstar remarked, “Renewables were the sideshow as natural gas competed with coal, but we see natural gas and renewables increasingly competing with each other. Increasingly, there are a number of cases where it is more advantageous for customers and utilities to invest in solar and wind versus natural gas.”

The diminishing role of oil in the S&P 500 and the stability of gold is a reminder that conventional wisdom, like everything else, has an expiration date. Oil burns away, but gold endures.