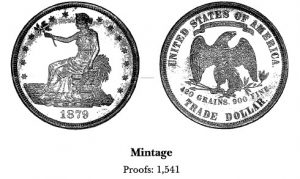

Ultra-Rare US Trade Dollar: Coin History

Posted on — 3 CommentsIn the late 1860s and early 1870s trade between the U.S. and China was increasing. However, a threat to this trading emerged from the unlikeliest of places; the Mexican peso.

*

*

Many Chinese businesses preferred the peso to U.S. currency because the peso contained more silver than the standard U.S. dollar. This characteristic of business abroad meant that U.S. businesses had to exchange their dollars for pesos which generated costly broker fees. The government’s answer to this problem was the US trade dollar.

The U.S. started to mint trade dollar coins in 1873. The trade dollar consisted of 90% silver and weighed slightly more than the peso (420 grains vs. 416). During the first two years of production the U.S. sent nearly all the minted coins abroad to ease trade problems. Soon after, they granted the coins the status of legal tender domestically.

The trade dollar was a success abroad. Chinese businesses embraced the coin and preferred its heavier weight over the peso. Chinese merchants often put a “chop” mark on their U.S. trade dollars. These punched Chinese characters indented on the surface of the coin were likely a method for testing the authenticity of the piece. As the coin passed from one merchant to another it would occasionally receive multiple chop marks.

In time, demand for the US trade dollar surged. However, mining activity at home altered the course of history for the trade dollar.

U.S. mines in the western regions of the country were yielding enormous amounts of silver. This influx of precious metal disrupted the supply and demand dynamics in the market. Silver prices plummeted. As a result, the trade dollar fell to an intrinsic value of just 80 cents. Soon after, the U.S. saw large amounts of trade dollars flow back into the country where Americans spent the coins at their face value. In response, Congress acted and revoked the coin’s status as legal tender in July of 1876. They continued to mint the coin, but only for the purpose of exportation.

Just two years later, Treasury Secretary John Sherman ended production of trade dollar coins. However, from 1879 forward, the Treasury issued proof strikes expressly for collectors. Eventually, in early 1887, legislators passed a law allowing those holding U.S. trade dollars to redeem their coins. This act brought approximately 8 million U.S. trade dollars back into the government’s hands.

With the passing of the Coinage Act of 1965, trade dollars became legal tender once more. Today, the coins are highly sought after by collectors. The 1884 and 1885 trade dollars are considered to be the rarest of these desirable coins. Prior to 1908, these coins were not known to exist. Officials and collectors learned that ten proofs dated 1884, and five proofs dated 1885 were minted. The production of these extra pieces was not recorded in official records. In 2006, a collector purchased an 1885 U.S. trade dollar in a private transaction for $3.3 million.

Collectors often use extra scrutiny when collecting trade dollar coins as their rarity, value, and history make them a prime target for counterfeiters.

*Image courtesy of PCGS

Rainfall and Other Unseen Forces Influencing Gold

Posted on — Leave a commentThe vast ocean of data available to people today reveals an indisputable truth: things are not what they seem. Dive below the surface of the waters and you’ll learn that many unseen forces are pushing and pulling on our market.

Sometime these forces are nefarious. Examples include the misrepresentation of risk during the global financial crises and the inflated balance sheets during the dot com bust. However, some of these unseen forces are simply acts of nature. Consider rainfall and gold.

As we’ve discussed in previous articles at Blanchard, India consumes 849 metric tons of gold per year representing the second largest demand in the world. Only China consumes more and by a small margin. Moreover, the middle class in India is projected to increase to 547 million within the next six years. This has meaning for gold because many expect those joining the middle class to add to these gold consumption figures.

So, where does rainfall factor into this picture? The rural population within India accounts for an estimated 60-70 percent of gold consumption within the country. Rainfall is critical to their way of life. With the right amount of rain those living in rural regions can ensure crop yields and, as a result, their income and their income will influence their ability to buy gold.

In fact, the weather during India’s monsoon season has strong implications for the country’s entire economy. Even when the level of rainfall drops below 90 percent of the seasonal average, the government in India considers the situation to be a drought. When India suffers a dry period the rest of the world notices because the country is the second-largest producer of rice, wheat, sugar and cotton in the world. Consider that in 2009, unfavorable weather forced India to import sugar. As a result, global prices spiked, and inflation followed. The monsoon season even has implications for the country’s power grid. With more rainfall comes better irrigation and more substantial hydropower output.

India’s rainfall is a reminder that many of the factors underpinning movements in the price of gold are things we rarely consider. For example, the strength of India’s currency, the Rupee, also has a major influence on gold prices. Much of the gold demand within the country is satisfied with imports. When the value of the Rupee, relative to other global currencies, falls imports generally decrease and gold follows.

Additionally, the festival and wedding season in the country influence gold purchases given that many people in the country buy gold for these occasions. Gold has a major place in the country’s cultural legacy. Gold is a common wedding gift and carries far more religious import in India than any other country.

As the world becomes a global marketplace and economies exact increasing influence on one another, previously ignored factors like rainfall in India will become important to savvy and strategic gold investors.

Why You Should Add Silver to Your Portfolio Now

Posted on — Leave a commentLong considered the ‘poor cousin’ to gold, silver is forecast to shine in 2019 with a rally of more than 10% forecast by Capital Economics.

“We expect silver prices to rally by more than 10% this year as safe-haven demand returns and mine production falters,” Capital Economics wrote in a March 19 research note to clients.

Silver climbed in recent months after marking out a solid bottom on the daily chart around the $14.20 an ounce area. Silver recently traded around $15.40 an ounce.

Capital Economics projects silver gains toward $17.50 an ounce by year-end.

2 Key Drivers for Silver Gains

Falling silver mine output in 2019, combined with fresh safe-haven investment demand means “silver will regain its status as one of the top commodity price performers in 2019,” Capital Economics said. Let’s break that down further.

Safe haven demand

Sluggish economic growth both in the U.S. and around the globe will pressure stock markets lower, Capital Economics projects. In turn, this will stimulate investor “risk aversion” and spark asset reallocation into safe-havens including gold and silver, the firm predicts.

Supply is stuttering

Silver production at the world’s largest mines has declined in recent years. A dozen of the largest silver mines registered declining output of about 9% in 2018. Notably, “the Escobal mine remains closed and we don’t expect it to restart until 2020 at the earliest,” Capital Economics said.

Investment demand is already picking up

Investors clamoring for safe-haven tangible assets already boosted U.S. silver coin demand in early 2019. The U.S. Mint briefly ran out of silver coin inventory in February due to the heightened demand.

Investing Options

Adding physical silver to your portfolio is easy.

You can buy a 2019 1 ounce American Silver Eagle coin for as little as $18.19 an ounce (market prices constantly fluctuate).

All silver and gold bullion coins carry a small premium over the spot price of silver or gold– usually 3-4%. That cover the coin’s manufacture and handling, but that premium is a part of the return you receive when you sell.

Allocating larger investments to silver bullion is simplified through a monster box purchase. Learn more about that here.

The Bottom Line

Silver has under-performed gold dramatically in recent months. But, major investment firms turned bullish on silver. A large price rally is predicted this year in silver. If you haven’t fully diversified your portfolio, consider adding silver assets now.

When the Road Curves for Investors

Posted on — Leave a commentThere will always be a few bends in the road to long-term wealth creation. Perhaps curves is a better word than bends.

Recently, the yield curve inverted. This has spooked investors. The last time this happened we were in the opening scenes of the global financial crisis.

Why does an inverted yield curve matter? Analysts have long noted that most, though not all, recessions are preceded by an inverted curve. Therefore, many consider an inverted curve to be harbinger of doom. In fact, an inverted yield curve has preceded the last seven recessions.

Viewing an inverted yield curve with some trepidation makes sense. The reason: when the curve is inverted it signals that investors, on the whole, are less optimistic about the short-run than they are about the long-run. Therefore, they demand more of a return on shorter-term investments than those that are long-term. This is why people took notice this week when the spread between 3-month and 10-year U.S. Treasury’s fell into negative territory.

Part of this development is due to the Federal Reserve’s recent decision to withhold from raising interest rates again this year. “The U.S. Federal Reserve suggested U.S. economic growth was slowing, which has spilled over into notions that the rest of the world economy might be experiencing slower growth,” remarked a senior analyst with Kitco Metals.

Concerns about slowing global growth are more than emotional, they’re empirical. Consider that factory output in the Eurozone has fallen this month at a faster pace than it has in six years. Stocks have been in decline in the U.S., France, Germany, and the U.K.

Despite some favorable conditions in the U.S., namely low unemployment, an improving housing market and respectable corporate earnings, many are concerned that economic troubles abroad will destabilize other economies. It’s not surprising that gold recently edged higher and is up 0.8 percent this week. “I still believe that with the geopolitical and the Brexit situation, we may be heading higher,” remarked Afshin Nabavi, a senior vice president at Swiss financial services company MKS SA.

Concerns about troubles in Europe spilling over into the U.S. are not unfounded given the increasing correlation between the performance of U.S. stock with European stocks. Investors are learning that diversification means something different today. It’s not enough to hold a range of stocks across sectors. True diversification now means owning various asset classes including precious metals.

In fact, some investors are broadening their focus beyond gold, they’re capitalizing on opportunities within silver because the ratio of the price of one ounce of gold to one ounce of silver is at 85 now. This number is significant because rarely does this ratio exceed 80. The bottom line: silver is relatively inexpensive.

Some are taking this low cost and a cooling equities picture as an indication that now is the perfect time to diversify. Including precious metals in a portfolio gives investors the backing of a universally accepted commodity that carries intrinsic value.

4 Investing Ideas for Spring

Posted on — 1 CommentDaylight is getting longer every day now.

Each March, the Spring Equinox marks the day in which daylight equals to night. The word equinox stems from the Latin words for “equal night”—aequus (equal) and nox (night).

Spring is a time of renewal and rebirth. The earth awakens from its frozen wintry tundra and trees, flowers and gardens begin to bloom.

Spring is the perfect time for investors to plant seeds for growth in their portfolio too.

We assess 4 key market trends and offer insights.

- The Gold Trend Points Higher

Since August, gold has climbed 14%. Goldman Sachs recently upped its 12-month forecast for gold to $1,450. Gold is in an uptrend and there is more reward on the upside.

Investing in gold bullion offers investors a safe haven, a portfolio diversifier, an inflation hedge and a vehicle to grow your wealth. The trend is your friend.

Consider adding gold bullion to your portfolio now in order to take advantage of the rising price trend.

- Rare Coin Index Eased in March

The Rare Coin Values Index, which tracks the percent change in retail prices for 87 rare U.S. coins since January 2000, hit a new all-time high in January and then again in February. The index eased slightly in March, which marked only the third decline in the last 12 months.

The macro trend for rare coins remains solidly bullish. Investors of all kinds have been turning to rare coins for capital appreciation, diversification, non-correlation to stocks and as a hedge against inflation.

Consider adding a new coin to your portfolio now as the March pullback offers a great time to buy in the uptrend. Choose the rarest coin that you can afford. That could be a $2,000 coin or a $20,000 coin. It is the rarity factor that will maintain its strong long-term demand and price appreciation.

- Silver Is Cheap

The gold/silver ratio reflects the number of silver ounces it takes to buy an ounce of gold. The gold/silver ratio offers valuable insights to determine if one metal is over or undervalued versus the other. Historically, there have been only a few occasions that the gold-silver ratio traded above 80.

The gold/silver ratio stands at 85 right now. That signals that silver is dramatically undervalued and is a strong buy signal for the metal.

Consider the purchase of a monster box of American Silver Eagle coins.

- Invest your Tax Refund in Tangible Assets

If you find yourself with some extra funds from the IRS this spring, consider adding to your tangible assets portfolio.

You can diversify your tangible assets portfolio with the purchase of a new kind of bullion or coin. Well diversified portfolios include a mix of gold, silver bullion and rare coins.

The Storied History of the Morgan Dollar

Posted on — Leave a commentIn 1873 the nation took steps to battle an unexpected problem with the money supply in the United States. Officials initiated the Fourth Coinage Act.

Prior to the Fourth Coinage Act, citizens were permitted to bring their silver to the mint and have the metal pressed into coins for use as legal tender. This service, which carried a fee, created problems when the intrinsic value of silver fell below the face value of the coin minted. The difference in these two values presented opportunities for fast, easy wealth to silver holders. This practice created inflation problems, which led officials to revise the laws pertaining to the US Mint.

Changing these laws had an enormous impact on the US economy because it ended the monetary standard known as bimetallism. Under bimetallism the value of currency is defined in terms of its equivalent value in one of two metals. Commonly, these two metals are gold and silver. Some were happy to see bimetallism disappear, citing problems with the system, like Gresham’s Law. This principle, in its simplest form, states that “bad money drives out good.” That is, in time, the more valuable of the two metals will eventually disappear from circulation because people will horde the more valuable commodity.

However, in the same year of Fourth Coinage Act the United States and Europe suffered from a period of economic depression known as the Panic of 1873. There were numerous causes. Inflation, speculative investments, and massive property losses from the Chicago and Boston fires all contributed. Soon, the nation took steps to resume the free coinage of silver with the Bland-Allison Act. As a result, the Treasury would purchase two to four million dollars worth of silver on a monthly basis for the purpose of minting what became the Morgan Dollar. The decision was the result of a contentious period in US history, but the controversy was just beginning.

The original design featured an eagle on one side with eight tail feathers. This detail was a departure from all previous U.S. coins in which the eagle had an uneven number of tail feathers. Eventually, officials decided to change the design back the customary seven feathers. The Philadelphia Mint was the only facility issuing the Morgan Dollar at the time, therefore, they re-cast the dies. As a result, a few rare Morgan Dollars have seven tail feathers superimposed over the original eight.

Once the design was corrected, the Mint began issuing the Morgan Dollar in vast quantities. Much of the pressure to mint so many came from silver miners who wanted a stable and predictable demand for their metal. With so many on hand, millions of coins were stored in U.S. vaults. Eventually, the government found a use for the coins when World War I demanded more resources for the war effort. The Mint melted every Morgan Dollar they had – or so they thought.

In the early 1960s officials conducted an audit of the Treasury’s holdings. To everyone’s surprise, there was a forgotten stockpile of Morgan Dollars sealed, and abandoned in the main building of the Treasury in Washington, D.C. The government decided to sell them to the public.

The demand was insatiable. More than 400,00 orders came through with approximately half turned away due to limited availability.

Today, the coin remains popular with collectors because it represents such a diversity of story lines, from bimetallism, to tail feathers, to a forgotten cache.

A Small Coin with Huge Historical Significance

Posted on — Leave a commentThe United States of America was still in its infancy in the early 1790’s. The Founding Fathers signed the Constitution just a few years before in 1787 and many landmark events that shaped the country we are today occurred in the years that followed.

Up until this time, American colonists were forced to use European coins for everyday purchases. The Spanish dollar was a popular method of transactions at that time.

The nation faced a shortage of small change and it was clear that America needed its own system of currency. America needed its own coinage, especially small change, and they needed it fast.

The first Secretary of the Treasury – Alexander Hamilton – began outlining a system for America’s coins in 1790.

First coin struck by U.S. government

Out of that plan, the Half Disme, or half a dime, was the first coin ever struck by the authority of Congress under the April 1792 Mint Act.

The story of how the Half Disme got its name traces back to both Hamilton and Thomas Jefferson. They advocated the use of the decimal system as the standard in U.S. money.

Jefferson explained: “The most easy ratio of multiplication and division is that of ten.”

Just over 100 years earlier, a French mathematician invented the decimal system in a book called “La Disme” or “The Tenth.” The 10-cent piece represented 1/10 of a dollar and was thus named the disme. Most Americans pronounced the French word “dime” and the “s” was later dropped.

Silver coins signaled strength to the world

In the 18th century, the minting of silver coins was considered an indicator of a country’s economic strength. Some historians believe this was behind President Washington’s push to create the Half Dismes as quickly as possible.

As the Half Disme was the smallest silver coin, it enabled the largest minting from the limited supply of available silver. In fact, President Washington brought $100 worth of his own bullion and coin to the Mint to use in the first strike.

The old name, for the Half Dismes, sometimes seen in 19th century writings, calls the first coin the “Washington Half Dismes.”

The Philadelphia Mint hadn’t even opened its doors yet

In the summer of 1792, the Philadelphia Mint, located on Seventh Street in downtown Philadelphia near the Arch was still under construction.

Impatient to get U.S. silver coins minted, the Half Dismes were struck in the cellar of a building owned by John Harper at 6th and Cherry Streets in Philadelphia.

A total of 1,500 silver Half Dismes were struck in July 1792.

Thomas Jefferson, then Secretary of State noted the event on July 13, 1792, in his household account book: “rec’d from the mint 1,500 half dimes of the new coinage.”

The Half Disme was considered a pattern coin, intended as a test to show the size, form and design of the future coins. Yet, many 1792 Half Dismes circulated.

Construction on the Philadelphia mint building was finalized soon after in September.

The coin description

Many in the House of Representatives advocated for a representation of the President’s head on the obverse of the coins. Washington nixed that idea fast.

Engraver Robert Birch designed the early 1792 Half Dismes. The obverse features the head of Liberty facing left, with the date 1792 below. The reverse portrays an eagle flying left with the words HALF DISME below.

History in your hands

While today’s dime may not resemble the Half Disme, it is a direct descendent of this landmark coin that was minted in 1792. It’s a small coin with huge historical significance.

In 2018, the finest known 1792 Half Disme, graded MS68 sold for $1,985,000. That coin was owned by the first United States Mint Director David Rittenhouse. Lesser condition Half Dismes can sell for much less.

One of the Most Influential Factors Driving Gold Demand

Posted on — Leave a commentWhen we think of demand, we think of supply. The two factors are inextricably linked. However, focusing only on supply when analyzing gold demand ignores part of the picture. There is another, less frequently discussed factor in play: income.

Rising incomes, especially in developing countries, will amplify gold consumption. This connection is especially true in India where, according to the World Gold Council, every 1% increase in income corresponds to a 1% increase in gold demand. In fact, this one-to-one correlation is even stronger than the connection between gold prices and demand. Consider that, according to the same research, for each 1 percent increase in price, gold demand only falls by 0.5 percent.

These findings have major implications, given that the middle class in India is projected to increase to 547 million within the next six years. This could lead to an annual gold demand of anywhere from 850 tons to 950 tons per year and as much as a 30 percent increase over the total demand in 2017.

The primary driver of middle class expansion in India is GDP growth. As recently as 2017, India experienced a 6.6 percent increase in GDP compared to just 2.3 percent here in the US.

Impressive growth figures like this are not outliers. In 2016, India’s GDP grew by 7.1 percent and in 2015 it grew by 8.2 percent. The trend is clear.

In short: every year, more people in India are spending more money. Some additional figures from the World Economic Forum add detail to this picture:

- From 1990 to 2015, the number of households with more than $10,000 in disposable income has surged from 2.5 million to 50 million

- In less than eight years, India is expected to have more middle class citizens than any country

- Between 2005 and 2014 household savings have tripled

India is a major focus for analysts projecting future gold demand and prices not only because spending power is rising in the country, but also because India already represents one of the largest markets for gold on the planet. Gold is considered more than just a store of wealth, it is considered a status symbol and is involved in many important rituals in the country. Gold is part of the culture.

Analysts expect India’s economy to continue growing reaching 7.4 percent this year alone and the key takeaway is that predicting the future of gold prices is more complicated than considering supply and demand. Savvy investors need to look to countries like India to understand how socioeconomic factors and GDP growth are spurring purchases and eventually lifting prices. In fact, the most observant analysts will narrow their focus to even more specific areas of the country like the rural population which accounts for an estimated 60-70 percent of gold consumption within the country. As this demographic prospers, so do all gold holders.

The Chinese Gold Rush of 2019

Posted on — Leave a commentIt’s a town in China you may have never heard of.

Beigao, a town of roughly 100,000 people in the Putian municipal area, the city’s main street boasts 20 gold shops.

Yes. 20 gold shops in a town of 100,000 Chinese citizens.

It’s no surprise.

Economic advances in China in recent decades opened the door to a rising and growing middle class with newfound wealth. What do they want to buy with their newfound income? Gold. Just like their parents did and their parents before them.

China has been the world’s largest producer since 2007. However, China buys more than double the amount of gold than it mines from the ground every year.

The Chinese voracious appetite to own physical gold comes from a different place than most American’s interest in owning precious metals. Eastern demand stems from a deep-seated cultural affinity for holding the yellow metal. It is tradition; it is a sign of having made it to the middle class. It is a way to save for a dowry. Jewelry is a way to display a family’s wealth.

In today’s China, a younger generation of recently married people now have more to spend on jewelry. And, they are spending.

“Today, young buyers “think nothing of spending a few thousand renminbi on a necklace” as a fashion statement, says Zhang Guowang, a fourth-generation jeweler who runs Huachang Jewelry, one of the largest in Putian, with a few hundred stores around China,” according to The Economist.

As more Chinese citizens climb into the middle class, they now have the opportunity to purchase physical gold, as is evidenced by enough demand to support 20 gold shops in the town of Beigao. These trends are set in place and will only grow and expand in the years ahead.

China is moving forward as a powerhouse in the global economy, now the world’s second largest economy. As China continues to drive global growth forward in a new emerging market age, expect its citizens to drive a new Golden Age in physical gold demand. A new age is rising from the East, which has broad positive implications for gold in the years ahead.

20 Top Analysts Forecast Gold above $1,400 in 2019

Posted on — Leave a commentHow high could gold climb in 2019?

Twenty of the world’s most esteemed precious metals analysts projected a high above $1,400 an ounce for gold in the Forecast 2019 survey published by the London Bullion Market Association.

The LBMA, which is a standards setting body for the precious metals industry, polled 30 analysts for its annual survey. Two-thirds of those analysts expect gold to hit or surpass the $1,400 level in 2019.

Here’s WHY some of these analysts were so positive on the outlook for gold, according to the LBMA survey:

Eddie Nagao of the Sumitomo Corporation in Tokyo was the most bullish. Nagao projected that gold could trade as high as $1,475 in 2019.

“The Fed won’t be able to hike rates as much as it would want. The probability of a US recession is higher now and volatility of the markets is expected to rise as there will be fewer risk underwriters under such circumstance. Gold is to be one of the favored asset classes among institutional and private investors,” Nagao said.

Frederic Panizzutof the Mks Pamp Group in Geneva projects that gold could trade as high as $1,460 in 2019.

“We do expect the Fed to be on a wait and see stance, and to take a slower pace in hiking interest rates. In such a scenario, the US dollar might not strengthen much further, especially in the second half of the year. This combined with the ongoing US-China trade debates, geopolitical tensions, political turmoil and additional stock market downside corrections will be supportive for gold. More volatility in stock markets shall trigger safe haven gold buying. We view 2019 as a year of assets rebalancing and fresh money to flow into gold. The official sector shall continue to be a net buyer,” Panizzutof said.

Suki Cooper of Standard Chartered, New York called a gold high at $1,440 an ounce in 2019.

“Scaling back of Fed rate hike expectations, a weaker USD and lower US Treasury yields paint a favorable backdrop for gold prices…Gold has reasserted its safe haven status in past weeks amid a weaker equity market and easing trade tensions, and lingering political risks such as Brexit that could expose prices to the upside…Official-sector purchases are set to mark the strongest year in three years, buoyed by new market entrants such as Hungary, Poland and India, as well as established buyers such as Russia, Kazakhstan and Turkey. We expect this strength to continue in 2019,” Cooper said.

Cameron Alexander at GFMS Refinitiv in Perth sees gold climbing to $1,415 per ounce in 2019.

“We expect gold prices to continue to benefit from continued economic uncertainty and a slowdown in the US economy. As we approach the end of the economic growth cycle, demand for defensive assets is likely to pick up as concerns deepen about the widening US budget deficit and as the tariff-driven trade war starts to damage the country’s economy,” Alexander said.

The Bottom Line

The price of gold hit a 10-month high last week.

Industry analysts around the world expect gold to climb even higher. If you’ve been thinking about adding more gold to your portfolio, now is a great time to buy before prices rise even more. Get started here.