Monday Morning Wrap Up: April 13, 2020

Posted on — 1 CommentA message from David Beahm

President and CEO

Crisis Reshapes the Future

Black Swan. Nassim Taleb, a professor of risk engineering at New York University, popularized the term: Black Swan. It is defined as a highly improbable event with major consequences.

Think back just a few months ago.

At the beginning of 2020, the stock market was hitting new all-time highs, the unemployment rate was at a 50-year low, the economy continued to grow in the longest post-WWII expansion phase on record.

The COVID-19 health and economic crisis most certainly fits the definition of a Black Swan.

Fast forward to mid-April. There are reports the rate of coronavirus infection could be close to peaking in some states. Yet, America still faces weeks and months ahead of uncertainty and the potential for a resurgence in the virus.

Individuals, small businesses and corporations must work through the economic devastation that hit our country like a deadly F-5 tornado that struck Kansas unexpectedly one spring afternoon. This will take time. Things will look different in the months and years ahead.

Main Street and Wall Street are bracing for a second quarter that will likely record the deepest economic decline our generation has ever seen. Economists predict a double-digit unemployment rate that could easily last well into summer.

The COVID-19 stock market crash triggered a massive run on physical gold as individuals search for safety in the economic storm. This bull run in gold is projected to last throughout this current decade with record price highs.

Why? The COVID-19 crisis is reshaping our future with economic recession, bankruptcies, a massive increase in new government debt, and an unlimited expansion of the Federal Reserve’s money printing polices. QE infinity.

Even before this crisis hit, the U.S. economy was skating along in a bubble blown up by a decade of ultra-low and accommodative Federal Reserve monetary policy. Never before has our country seen interest rates so low for so long. The bubble has now burst and what lies ahead will be something we have never seen before. The crisis is setting gold up for one of the biggest bull phases in history.

Here are a few key news events from last week that will continue to support gains in gold in the months and years ahead.

National Debt Tops $24 Trillion

The national debt hit a new all-time record high above $24 trillion last week. In 1996, the national debt stood at $5 trillion. In 24 years, the debt has nearly quintupled.

The crisis is reshaping our future in very significant ways. What are the future ramifications of unsustainable debt?

- Higher interest rates.

- Lower economic growth.

- Less money to spend on government programs.

- Higher income tax rates.

In the future, this means Americans will face higher interest rates as the government will have to offer better rates to fund its debt repayment, lower levels of fiscal spending on things like the military, health research, education, social programs like Social Security and Medicare as more and more of the budget will have to go toward debt repayment, and it will mean higher income tax rates.

Economy in Free Fall

The lockdown measures currently in place across America will result in a double-digit economic contraction and recession in Q2 GDP. The consumer spending sector is most impacted by this crisis and conservative estimates peg second quarter gross domestic product at a stunning 20% decline. Former Fed Chair Yellen recently warned the economy could fall 30% this quarter.

Nearly 17 million Americans have now filed for unemployment benefits since mid-March. At this pace, a 20% unemployment rate is easy to expect. That is nearly double the unemployment rate we saw in the 2007-09 recession, but not quite as severe as the 25% unemployment rate seen during the 1930’s Great Depression. Every economic recession takes time to heal. It could be years before the unemployment rate comes back down.

Consumers Throw in the Towel

No surprise, consumer confidence plunged to an 8-year low in April. Last week, we saw the University of Michigan sentiment survey tumble 18.1 points to 71.0. The plummeting confidence numbers were driven primarily by the current conditions index. That’s no surprise since almost 17 million Americans lost their jobs in less than one month.

Bear Market Rallies – Beware of False Starts

While the stock market saw mild improvement last week, bear market rallies are a common phenomenon. After the market crash in 2008, the S&P 500 staged six different bear market bounces. Beware of false starts.

Capital Economics wrote in a research note to clients that a “sustained recovery in equity prices is unlikely until clear evidence emerges that coronavirus is being brought under control around the world. That still seems some way off…. What’s more, big increases in equity prices are quite common after major corrections and don’t necessarily mean that bear markets are over. For example, the rise in the Euro Stoxx 50 since mid-March is reminiscent of what happened to that index a similar amount of time after the collapse of Lehman Brothers during the Global Financial Crisis (GFC). It subsequently fell back to a fresh low.”

Fed Money Printing

In recent weeks, the Federal Reserve bought almost $1.2 trillion of government securities as new money printing and QE infinity kicks into gear. What lies ahead? As the U.S. Treasury auctions new bonds to pay for the $2 trillion fiscal stimulus package Congress just approved, the Fed will have to keep buying to prevent a massive spike in interest rates.

It is a like a house of cards. The Treasury sells bonds to fund public programs like the emergency stimulus package. Then, the Fed prints money to buy those bonds.

All houses of cards eventually fall to the ground.

Gold is an asset that will be left standing when that happens.

Black Swan Events

While you can’t predict what a black swan event could be, or when it will hit, we do know that they emerge at a fairly reliable pace throughout history.

We as a country will survive this crisis, but our future will be reshaped by it. And, we know there will be another black swan in the future.

Throughout it all, gold will continue to provide individuals a safe-haven investment to grow, protect and preserve wealth in these uncertain times.

Best wishes,

David

What Questions Do You Have?

Email questions for me to answer in next week’s Monday Morning Wrap at: [email protected] or email just to let us know if you like this commentary or how we can make it better. Prefer the phone? Call us at 1-866-629-2281. We want to hear from you.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Special Report: The Long Bear Market in Silver – Part Two

Posted on — Leave a commentThis is part two of our special report on the long silver bear market. You can read part one of this comprehensive article here.

Why Should You Act Now?

CPM has an impressive track record with recommendations. They don’t come often and when they do they are extremely profitable.

- CPM’s previous intermediate-term investor recommendation on silver was on 2 May 2011, when silver touched $48.19 and CPM advised selling.

- The theoretical return from following CPM’s buy and sell recommendations would have been 57,434.3%, or an 18.9% compounded return.

Major Buy Signal in Gold/Silver Ratio

Here’s another reason you should act now.

The gold/silver ratio is showing a historical buy signal, which is a reliable buy and sell indicator for silver in recent decades. Here’s some background.

Since 1971 – when the gold standard was ended, the price of gold and silver have floated freely within a large range. The gold/silver ratio hit a low at 14 in 1980 – when both gold and silver hit historical highs in the wake of massive double digit inflation in the United States. The ratio approached 100 in 1991 as silver prices tumbled to a 20-year low. Those are extreme anomalies however.

Where is the gold/silver ratio now? Another historical anomaly at 111!

What is this indicator? The gold/silver ratio is simply the amount of silver it takes to purchase one ounce of gold. The history of the gold/silver ratio can be traced as far back as Roman times. Then, the ratio was fixed at 12 or 12.5. In the 18th and 19th centuries governments around the world fixed the ratio as a way to ensure monetary stability – as gold and silver coins were widely used in trade, commerce and everyday purchases. For example, the Coinage Act of 1792 in the U.S. deemed the gold/silver ratio at 15:1.

In more recent decades, gold/silver ratio readings above 65 signaled that silver is severely undervalued and was a strong buy signal for the metal. The latest 111 reading is historically high, which means silver prices right now offers investors incredible long-term value. On the lower extreme, a very low gold/silver ratio under 50 signals that gold is cheap by historical measures.

Gold silver/ratio 65 > or greater means silver is a relative bargain

Gold silver/ratio 50 < or lower means gold is a relative bargain

The current 111 reading signals one of the best buying opportunities in silver since 2003 when silver was trading around $5.00 an ounce.

How High Could Silver Climb in 2020?

“CPM projects that silver prices might rise around 11.7% in 2020 on an annual average basis, to around $18.12 for the full year. Further price increases are expected later. Mine production is projected to be flat to slightly lower, while secondary recovery from scrap may rise somewhat due to increased recycling of spent electronics and other silver-bearing products due to heightened environmental awareness, more stringent recycling laws, and somewhat higher silver prices. Fabrication demand is projected to increase perhaps 1.6% in 2020 from 2019’s level of demand.”

“Further price increases are expected, but beyond 2020, and only when long-term investors resume buying larger volumes of physical silver. When that happens, silver prices could rise dramatically. It may be several years before that happens. Meanwhile silver prices are expected to rise modestly,” CPM Group said.

Buy Low, Sell High

Silver prices are higher now compared to where they have been in most of history, yet dramatically lower than the all-time high.

For perspective, the current silver price at around $15 an ounce level is well above the $4.00-$6.00 range where silver traded from late 1998 into late 2003. Yet, it is dramatically below the nearly $50 an ounce high in 2011.

Again, current silver prices are very low compared to the 2011 high.

If you buy silver now, there is potential for you to double or triple your money in a few years’ time as the bulls drive the market back toward the 2011 high.

Buy low, sell high – that’s something you probably learned in Econ 101.

Historical market opportunities usually don’t last long. Use the current softness in silver as an opportunity to build up your silver exposure. When prices are higher a year from now you’ll be glad you did.

Another Bullish View

Here’s what the Silver Institute said last month.

“The Silver Institute believes that macroeconomic and geopolitical conditions will remain broadly supportive for precious metals, encouraging investors to stay net buyers of silver overall, a development that should lift silver prices higher this year. Additionally, we see continued growth in physical silver investment, and forecast silver’s use as an industrial metal will rise in 2020.”

“The outlook for silver remains positive, with the annual average price projected to rise by 13% to a six-year high of $18.40 in 2020. This rally is premised mainly on a positive spill-over from gains in gold, as the yellow metal will continue to benefit from macroeconomic and geopolitical uncertainties across critical economies. Concerns about the state of the global economy will have possible negative consequences for the industrial metals, and by extension, silver. However, the weight of institutional money flowing into a relatively small market should prove sufficient for silver to outperform gold, and could cause the gold: silver ratio to drop to the mid to high-70s later this year,” the Silver Institute said.

Getting Started is Easy

From an investment standpoint, silver offers investors perhaps a once in a generation buying opportunity. Not only is silver a less expensive precious metal than gold, but it also sees additional demand from industry, technology and even medical uses, which supports the new bull market in silver ahead.

There are many ways to begin building a physical silver exposure including bullion coins, bars or for larger investments – there is bulk bullion. If you have questions, just ask. Blanchard can help.

Blanchard is a family-owned company with broad reach and deep roots in the precious metals market. We live by our name, which is known nationwide for honesty and integrity. Over the past 40 years, we have helped clients invest in American numismatic rarities and gold, silver, platinum, and palladium bullion. If you have additional questions about investing in silver, please leave them below and we can address them in a future post, or call us today to speak with a portfolio manager.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Special Report: The Long Bear Market in Silver – Part One

Posted on — 1 CommentInvestors big and small, domestic and foreign, piled heartily into gold since the start of the COVID-19 bear market in stocks. Gold is one of the best performing assets classes in the first quarter 2020, yet silver remains depressed.

Many investors wonder why.

The short answer is that 1) silver reacts more to commodity cycles than gold due to its large industrial demand and 2) investment demand for silver weakened since the 2011 price high.

If you are considering a new investment in silver now or have been disappointed in the recent performance of your silver holdings, we’ll discuss the larger outlook here.

Quick take: current silver prices offer individuals one of the best buying opportunities in the precious metal since late 2003.

Why Invest in Silver?

Just like gold, there are many reasons to invest in tangible assets like silver. These are broader reasons to buy silver, and don’t include the current market dynamics, which we will cover later on in this in-depth report.

Here are three of the many reasons that investors diversify into silver.

1. Silver is a precious metal like gold. Yet, it is also so much more.

It is a physical commodity widely used in a vast array of industrial purposes. Industrial demand for silver could slow in 2020 amid a slowdown in global economic growth in the wake of the coronavirus pandemic. Yet, silver industrial demand is expected to continue to expand broadly in the years ahead fueled by growing applications in electronics, solar panels, electronics and more. New industrial uses are being found for silver almost monthly it seems.

2. It is a monetary metal (quasi money).

Yes, it’s money. Silver has been used as money for over 4,000 years. Even recently, in China prior to the Communist takeover in 1949, the primary currency used there was U.S., Mexican and Cuban silver coins. After the Communists seized control, the new government ordered all the silver to be turned in. This is a useful explanation of how fairly recently silver still was used in daily transactions as money. Its size and lower cost value versus gold make it an excellent transactional form of money. Some individuals who purchase physical silver today view it as in investment in an asset that could again be used for daily commerce, while others accumulate silver as a portfolio diversifier and store of wealth.

3. Silver is also a financial asset, a store of value and a proven portfolio diversifier just like gold.

Research by the well-respected CPM Group reveals that the optimal level for silver portfolio diversification is around 5-10%, with benefits up to 25% of one’s portfolio based on historical results from 1968 through 2018. Portfolios with silver allocation yielded better returns, with lower risk.

Let’s look at some recent history, before analyzing current silver market dynamics and forecasts.

The Long Bear Market

Since trading at $49.80 on the New York spot market in 2011, silver fell into a commodity bear market cycle. Silver is more influenced than gold by traditional commodity market cycles due to the large amount of industrial demand for the metal.

In commodity markets, high and low cycles reliably form.

Why? High prices encourage production by miners – as they see an opportunity to cash in on the high prices. Since then, silver fell to a New York spot low at $11.75 last month. We believe the low is now in.

There is an old saying in the commodity world: “the cure for low prices, is low prices.”

When you think about it, it makes perfect sense. High prices encourage mining production, which is what occurred in 2011. That creates a glut of supply and the surplus we have seen in silver in recent years.

Meanwhile, low prices decrease production as mining is less profitable, which is turn creates a supply squeeze.

Because of the large industrial demand for silver, the supply/demand conditions that dictate commodity market cycles have a larger impact on the price of silver versus gold.

Experts are optimistic that the silver bear is bottoming out right now. Silver is already showing signs of turning higher following last month’s liquidity wash-out, where investors sold hard assets like silver to cover margin calls in the stock market crash.

Don’t forget, part of the reason silver climbed to nearly $50 an ounce in 2011 was amid America’s debt ceiling crisis with widespread concerns the U.S. could default on its debt. The S&P ratings agency issued a negative outlook on US AAA debt, for the first time in history. In August, S&P downgraded US debt in a major slap in the face and warning signal to US policymakers from AAA to AA+.

Into the 2011 high, there was massive investment demand for silver as a monetary metal and store of value.

Once U.S. policymakers addressed the debt ceiling, investors began to take profits on silver which had climbed from a low around $8.75 in 2008 into the $49.80 New York spot high in 2011, and that combined with increased silver production (supply), the bear market began. We are likely at a new inflection point and expect rising investment demand for silver to continue throughout 2020.

3 Major Drivers for New Uptrend in Silver

Here are three key factors that will drive silver higher in the years ahead.

1. Falling supply

- Total annual silver supply is declining. After peaking in 2016, silver supply fell in 2017, 2018 and 2019.

- The global economy is already forecast to skid to its deepest recession in 40 years in the wake of the COVID-19 pandemic. Slower growth will decrease mining production, which will decrease silver supply, setting the market up for a shortage as we emerge from the recession.

2. Increasing industrial demand

- Solar panel use hits new records in 2019. Jewelry and silverware demand remains strong. Electronics demand continues to climb for the past five years. New innovative uses for silver are increasing industrial demand, which will hit an important inflection point as we come out of the recession with a physical shortage. The supply/demand imbalance will be a major factor propelling silver higher in the next bull phase.

3. Rise in investment demand

- Just as we saw in the 2008-2009 crisis, investment demand soared amid concerns about fiat money devaluation and a loss of confidence in government and rising government debt levels. We saw a massive surge in physical buying in silver over the last month. This will continue to expand as the recession deepens and the central bank continues its experimental money printing policies and the Federal government continues on an unsustainable path of reckless government borrowing. Investment demand will soon become another major driver in the new bull market in silver.

Intermediate-Term Buy Recommendation

In December 2019, CPM Group issued a silver buy recommendation for investors with an intermediate-term investment horizon, which CPM puts as a two- to three-year time horizon.

“The silver market is at a critical vertex at present,” CPM Group’s Vice President in charge of Research Rohit Savant said in announcing the buy recommendation. “Silver market fundamentals are precariously similar to the critically poor conditions that existed in 1989. Our expectations are that the market may avoid the long period of net investor silver selling and low prices that followed from that year, however. Prices seem more likely to rise in the years ahead rather that to decline. There are many external as well as internal factors behind our analysis. That said, super bulls will continue to be disappointed by silver.”

Join us tomorrow for Part 2 of this special report on silver. If you have any questions, please comment below.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Monday Morning Wrap Up – April 6, 2020

Posted on — Leave a commentA message from David Beahm

President and CEO

Gold Shines: Shelter in the Storm

Nearly 90% of Americans are now under some sort of lockdown as the coronavirus pandemic halted daily life as we know it. Businesses are closing left and right as the number of COVID-19 cases are exploding in New York City and other parts of the country as well.

Job layoffs are skyrocketing at a faster pace than any time in U.S. history. Over 6.6 million Americans filed for unemployment in the last week of March, which followed a record number 3.3 million people in the previous week. Service sector jobs suffered most amid social distancing. These massive job losses are unprecedented and warn that the U.S. economy may be skipping recession and moving directly into a depression zone.

Economists now project over 20 million jobs lost by mid-May. While hard to comprehend, the economic consequences of this crisis are just beginning to ripple through the economy.

In the midst of this stunning event, gold is providing investors a safe-haven in the storm. Gold is shining in the midst of carnage across other asset classes. Even U.S. Treasuries are only returning a paltry 0.5%. Here’s a quick look at financial market performance:

Year-to-Date Returns

Gainers

| Palladium | +11% |

| Gold | +8% |

| U.S. Dollar Index | +5% |

| U.S. 10-Yr Treasury Yield | +0.5% |

Losers

| NASDAQ | -18% |

| Silver | -19% |

| S&P 500 | -23% |

| Platinum | -26% |

| Russell 2000 | -37% |

| Crude Oil | -47% |

Last week, we saw more early damage to the economy from the pandemic, with a surge in the March employment rate to 4.4%. Expect it to go higher. Much higher.

The stock market traded mostly sideways last week as investors hunkered down in a wait and see mode. With the pace of the pandemic still growing here in the U.S., the stock market is unlikely to stage any sort of recovery until there are actual signs the pandemic is slowing with fewer reported confirmed cases. Health officials believe that could be months away.

What about Silver?

Silver has under-performed gold and fell in price the last two months. Why? Silver is both an industrial and monetary metal. Because it is an industrial metal it trades and is vulnerable to commodity cycles. In addition to its monetary value, there are a wide range of manufacturing and technology uses for silver. Silver is utilized in solar panels, electronics, batteries, nanotechnology applications and even water purification systems, to name just a few applications. Industrial demand for silver is expected to weaken in the short-term if we face a global recession.

Yet, it is important for investors to remember that while the current commodity cycle has pressured silver, it is much more than just a commodity. It is a precious and monetary metal.

The gold/silver ratio historically has demonstrated reliable buy signals for silver in recent decades. That well respected technical indicator is flashing a huge “BUY” right now for silver.

Readings above 80 signal that silver is undervalued and is a strong buy signal for the metal.

And, we just hit 114!

A supply/demand shortage appears on the horizon for silver as the slowdown in the global economy will impact mining operations. Truly historical investment opportunities don’t come around every day. Your dollars buy dramatically more silver in the current market environment. If you’ve been considering adding to your precious metals portfolio, silver offers excellent value at current levels. How high could silver go in the years ahead? In 2011, silver climbed above the $49.00 an ounce level.

Stocks Heading Into Worst Six Months Period

Expect the stock market to test the recent lows again as new economic data released each week reveals how badly hit the economy is in the wake of this disaster. The seasonally documented “worst six months of the stock market” are just around the corner. Historically, the May through October period is the worst performing period of the year. Investors should brace for things to get worse in stocks before they get better.

Risky assets like stocks are unlikely to recover their losses for a long time. There is still time to diversify your portfolio and protect your assets with tangible assets. If you would like expert recommendations on asset allocation during these challenging times please contact us. We can help.

In the midst of this pandemic, it is worth remembering that this too will pass. For now, please take care of yourself and your loved ones. Check in on your parents and grandparents. Stay safe and healthy.

Best wishes,

David

What Questions Do You Have?

Email questions for me to answer in next week’s Monday Morning Wrap at: [email protected] or email just to let us know if you like this commentary or how we can make it better. Prefer the phone? Call us at 1-866-629-2281. We want to hear from you.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Monday Morning Wrap Up

Posted on — Leave a commentA message from David Beahm

President and CEO

Coronavirus Tidal Wave Still Gaining Strength

Like a massive tidal wave, the coronavirus continues to splash and hit every aspect of our lives.

The tsunami that is COVID-19 is still gaining strength out in the ocean. This wave has not yet fully hit the shores of America yet. Yes, we are seeing early impact waves which have now touched all 50 U.S. states.

Yet, we still have not yet experienced the full force of this devastating pandemic.

Millions of Americans are trapped at home under shelter in place orders in hopes of slowing the acceleration of the coronavirus pandemic. The historic health crisis quickly morphed into an economic crisis on both the deeply personal level of people who lost their jobs and paychecks to the national and global economy, which is now forecast to see the deepest global recession in 40 years.

We don’t know when we will turn the corner and stop the spread of the virus in America or how long-lasting the economic and financial damage will be. Last week we saw the first hard economic data on the damage from the early waves crashing into our economy. It was sobering.

Early Economic Damage – Jobless Claims Hit Record Level

The number of Americans filing for unemployment insurance skyrocketed to a never seen before 3.2 million. In just one week over 3 million Americans lost their jobs. To put that number in perspective that is five times as large as the peak during the 2008-2009 Great Recession. The previous one-week record was 700,000.

The unemployment rate is expected to soar above 10% by April or May. Economists warn that once the economy reopens, it is unlikely to reverse all these losses. Unemployment could remain high for years.

We are probably in a recession right now, Fed Chairman Powell said recently.

The longest economic expansion in U.S. history abruptly ended in the first quarter of 2020. And, economists have been piling on with forecasts for devastating declines from 15% or more in second quarter GDP. Yes, the Federal Reserve and U.S. government have gone all-out to stem the economic damage from this pandemic with a historic $2 trillion fiscal stimulus deal signed last week and the central bank’s pledge to print as much money as the economy needs to maintain liquidity. But, that leads us to the $64,000 question.

How Fast Can the Economy Recover?

I’m sorry to say that a $21 trillion economy like ours can’t be turned around that quickly.

Think of the U.S. economy like a fully loaded tanker ship.

It’s not as nimble as a small speedboat and can’t turn around on a dime. Metaphorically speaking, currently the tanker has hit an iceberg and is stranded. The Fed and the government are trying to prevent it from sinking.

Not everyone can telecommute from their job and over 3 million people stopped getting a paycheck last week. For a certain swath of American citizens, that means they can’t buy groceries or pay their rent.

Can Government Limit the Fallout?

They are trying. Last week, President Trump signed a massive $2 trillion stimulus package following Congressional passage. This marks the largest emergency aid package in U.S. history ever.

The package includes direct payments to middle and low-income Americans, expanded unemployment insurance benefits, loans to small businesses and corporations and funding for hospitals, who are desperately strained during this health crisis.

The government and the Fed’s recent actions are impressive.

Yet, they won’t prevent a massive blow to the economy in the second quarter, which could extend into the third quarter as well.

With Americans ordered to stay at home, many can’t work or spend. The package will ease the financial pain for those most at risk, enabling them to pay their rent and buy groceries. But, that’s just a short-term fix, not a long-term solution.

Last Week in the Markets

Gold shined last week soaring within a few dollars of the 2020 price high. The bull market in gold is going strong and just getting started.

Like most asset classes during this crisis, gold has been impacted by fast-moving dynamics, including an initial short-lived retreat as gold owners sold precious metals in order to pay back margin calls as the stock market crashed.

Gold continues to play an essential role in investor’s portfolios providing a source of liquidity in crises and an opportunity to preserve and protect and grow your wealth in a time of rampant fiat currency debasement, skyrocketing government debt and negative interest rates.

Gold is a hard currency, a tangible asset that you can hold in your hand. No central bank has the ability to print more gold and debase its value. This rally in gold is just getting started. Count on it.

Beware the Bear Market Bounce in Stocks

Many Americans saw stomach-turning news when checking their stock market accounts in recent weeks. The stock market is officially in a bear with over a 30% decline registered in the S&P 500 from the peak in Feb. 19. Oh, that all-time stock market high in mid-February seems like so long ago.

Last week saw a modest gain in the S&P 500 off the recent low. Traders like to call what we saw last week a ‘dead cat bounce.’ That refers to a brief bounce-back in the stock market after a major decline, right before stocks start tanking again.

The stock market gained in appreciation of the government’s $2 trillion stimulus package and the Fed’s all-out promise to print as much money as needed. While it’s a short-term salve, it doesn’t solve our current economic problems.

In fact, it only creates new problems for the future.

Rising U.S. debt levels already plagued our economy in recent months before this crisis hit.

The U.S. national debt stands at a record and rising $23 trillion. This latest fiscal stimulus package means our debt gets bigger fast. For perspective, the national debt stood at $19.9 trillion when President Trump was inaugurated, climbing 16% since the last presidential election. With the pandemic looming, the government has no choice but to step in. But, there will be a future cost.

Creating New U.S. Dollars at Light Speed

The Fed has announced its intention to do “whatever it takes” in its role as lender of last resort.

In the past three weeks alone, the Fed’s balance sheet exploded by more than $1 trillion, hitting $5.2 trillion last week. In just one week, the Fed bought almost $350 billion of Treasury securities, loaned $50 billion in banks through the discount window, gave out $28 billion through the primary dealer credit facility and another $31 billion to the money market mutual fund loan facility.

And, how did the Fed do all that? It printed new money.

What Could Lie Ahead?

The stimulus packages financed by the central bank is a house of cards. Eventually it will fall down. What could this mean for the future?

Inflation. Hyperinflation. Sky high interest rates in the future as America faces difficulty selling our bonds to pay interest on unsustainable debt.

The results of more government debt and unlimited Federal Reserve money printing continue our country on the unsustainable path of fiat currency degradation.

What exactly is the value of the printed piece of paper that says: “Federal Reserve Note. This note is legal tender for all debts public and private.” It’s becoming more and more worthless every day. Never mind the level of the U.S. dollar index. What matters is your future purchasing power with the dollars you own today.

Create more of anything and the value goes down. It’s simple supply and demand.

Gold Shines in This Environment

It’s no surprise that investors around the world have been adding physical gold to their portfolios at a furious pace in recent weeks.

It’s business as usual here at Blanchard and we are busier than ever. Unlike other dealers, we even have some products available to ship immediately.

Spot gold soared sharply higher toward the $1,670 an ounce level last week, within just a few dollars of the 2020 high seen at about $1,680 an ounce.

The bull trend in gold is strong and just getting started.

The government can print money to buy bonds to fund the $2 trillion fiscal package. While they can’t stand aside and do nothing, they are putting at risk the economic future of our country with these actions and the new problems they will create.

That’s why we are seeing so many investors turn to the safety of physical gold right now.

Over the past 45 years, we have helped clients invest in tangible assets like physical gold and numismatic rarities to protect and grow their wealth. It is our honor to help investors and collectors implement these essential diversification strategies to help them meet their financial goals. If you have any questions during these uncertain times, Blanchard has answers. We are here for you.

We have products available now and there is no minimum order.

I truly hope that you and your loved ones are healthy and well. Stay safe.

David

What Questions Do You Have?

Email questions for me to answer in next week’s Monday Morning Wrap at: [email protected] or email just to let us know if you like this commentary or how we can make it better. Prefer the phone? Call us at 1-866-629-2281. We want to hear from you.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Every Action Has a Consequence

Posted on — Leave a commentUnprecedented times lead to extraordinary measures.

The COVID-19 pandemic continues to wreak havoc upon the U.S. economy, the stock market and even the integrity of the financial system itself as lending freezes up.

The Fed is attacking this crisis in full force.

While the Fed’s actions may be necessary, they will have consequences. Let us explain.

The Federal Reserve stepped in on Monday with new quantitative easing (QE) measures, like those seen during the 2008-2009 global financial crisis.

Quantitative easing in plain English means the Fed buying securities – like mortgage backed securities. In the 2008 crisis, the Fed would state a specific amount – like $300 billion.

What’s different now?

This is open-ended quantitative easing. No dollar amount. As much as it takes.

“The central bank is shifting from being not just the lender of last resort, but now it is the buyer of last resort. Don’t ask how much they will buy, this is truly QE infinity,” Chris Rupkey, managing director and chief financial economist at MUFG, wrote in a research note to clients.

In an enlightening interview on 60 Minutes on CBS on Sunday evening, Neel Kashkari, the chief of the Minneapolis Fed, explained: the Fed is flooding the system with money and there is no end to their ability to do that.

Kashkari is the former U.S. Treasury official who ran the $700 billion government response to the 2008 financial crisis.

Here’s what else Kashkari said, paraphrased.

60 Minutes: Will the Federal Reserve ensure that banks have all the cash they need to satisfy whatever withdrawals may be coming?

Kashkari: Yes, we call it lender of last resort. This is why central banks exist. If everybody gets scared at the same time, and they demand their money back, that’s why the Federal Reserve is here to make sure there is liquidity and money to meet those demands. We will absolutely meet those demands.

60 Minutes: Is the Fed just going to print money?

Kashkari: That’s literally what Congress has told us to do. That is the authority they have given us. To print money and provide liquidity into the financial system, and that’s how we do it. We create it electronically and then we can also print it with Treasury department so you can get money out of your ATM.

The Action: These unprecedented actions could help prevent a Depression. Maybe.

The Consequence: The unlimited money printing will devalue the dollar. It’s Economics 101. More supply of anything decreases its value.

Never before has diversification in tangible assets been more important to protect and preserve your wealth. Gold is a limited resource and its value can’t be altered by government printing presses. Do you own enough gold and silver?

Watch the 60 Minutes Video Clip here.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

MONDAY MORNING WRAP UP

Posted on — 1 CommentA message from David Beahm

President and CEO

Depression Ahead?

The streets are eerily quiet. Traffic jams are non-existent.

A record 75 million Americans are under lockdown or shelter in place orders this Monday morning as the government goes all out in the fight against the COVID-19 health crisis. Experts agree this is the worst pandemic facing the world since the Spanish flu outbreak of 1918.

Yet, the morning paper is still delivered, the sun is shining and the birds are still chirping. We are living in unprecedented times in America. Medical science will ultimately prevail.

We don’t know how long it will take or how long this crisis will last. But, rest assured, this pandemic is temporary and we as a nation will recover. Eventually.

Facing reality, however, the extraordinary shutdown of economic activity will have ripple effects for the U.S. economy for potentially years to come.

This isn’t just a health threat. It’s a massive economic threat too.

Industries like restaurants, entertainment, tourism, airlines, and hotels are being crushed by the social distancing requirements in place.

Already the toll on workers is high as the world’s largest economy grinds to a halt.

It will get worse as citizens without jobs can’t pay their rent or mortgages, car payments or utility bills. Last week alone, over 281,000 Americans filed for unemployment insurance. That marks a 33% jump over the previous week and the highest level in two and a half years. It will get worse. Some economists peg the unemployment rate at 20% in the months ahead, the worst since the Great Depression in the 1930’s.

Shocking Second Quarter GDP Forecasts

Brace yourself. Second quarter GDP could shrink by a record 10% or even more.

JP Morgan forecasts a shocking 14% decline in the second quarter. Deutsche Bank predicts a 13% contraction in the second quarter, while Oxford Economics forecasts a 12% decline. Goldman Sachs now expects a stomach-wrenching 24% drop in the second quarter.

Numbers like that far exceed even the worst performance of the Great Recession in 2008, which registered an 8.4% decline in the fourth quarter 2008. And, you probably remember. That was bad. This will be worse.

Using Goldman Sachs economic estimates, this could translate into a loss of 14 million jobs this spring. Again, the 8.7 million jobs lost during the 2008-2009 Great Recession number pales in comparison.

The economic devastation that will lay in the rubble of this fight to save human lives could easily become the most serious economic crisis to face our nation since the Great Depression of the 1930’s.

Economists are divided on when the U.S. economy could begin a recovery, but there is none of the Pollyanna optimism exhibited by the Administration in its daily press briefings. Economists are much more sober.

A Growling Bear Grips Stocks

The S&P 500 sold off 32% from its all-time high peak on February 19 into Friday’s low.

Yes, the U.S. stock market has already lost over a third of its value.

The sickening declines over the past month wiped out all the gains achieved since Donald Trump was elected to office and more.

The percentage decline this far in March for the Dow Jones Industrial Average ranks currently as the second-worst in history after the 30.7% monthly collapse in September of 1931. But, wait. The month isn’t over yet.

Don’t expect a bottom in stocks just yet. The Dot.com bear market in 2001 saw the S&P 500 crash 49.1%. The global financial crisis in 2008-2009 sank the S&P 500 by 56.8%.

Using history as a guide, the 32% decline in stocks we’ve seen so far, likely has more to go.

Gold Swings Wildly As Investors Liquidate to Meet Stock Margin Calls and Need for Cash

Physical gold and silver demand skyrocketed in recent weeks as individual investors rushed to the safety of gold. As Americans woke up to fully face the threat of the coronavirus and its devastating impact on the economy and stock market, investors rushed to the safety of gold.

Massive gold and silver buy orders deluged Blanchard in recent weeks as investors seek to buy insurance through tangible asset ownership. During these unprecedented times, you can count on Blanchard as your trusted tangible asset partner. We can deliver your needs, although supply chain disruptions are creating a minor delivery delay in some instances.

Like the run on toilet paper and hand sanitizer, there has been a run on physical gold and silver in recent weeks. Some bullion dealers are out of stocks.

This may seem confusing to some investors to hear that bullion dealers are running out of supply while gold prices are falling on the world market.

The reason is that gold has been used to raise cash to cover margin calls amid the crash in the stock market. Gold is acting as the insurance policy that it is – a financial instrument that provides liquidity during times of crisis.

Yes, Gold Remains an Effective Portfolio Hedge

The recent volatility in gold is to be expected in the early days of a crisis as investors sell gold to raise cash. In the months ahead, new all-time highs above the $2,000 an ounce level gold are expected. Gold remains an effective portfolio hedge. Here’s what the World Gold Council said last week:

“We believe that, so far, gold has played an important role in portfolios as a source of liquidity and collateral. And we expect it will serve as a safe haven in the longer term.

Gold experienced pullbacks at the onset of the global financial crisis too, falling between 15% and 25% in US-dollar terms a couple of times during 2008. But by the end of that year, gold was one of the few assets – alongside US treasuries – to post positive returns.”

Gold Is Set To Soar

From a low at $680 an ounce in the fourth quarter 2008, gold more than doubled as it raced higher into the 2011 all-time high above $1,900 an ounce. We expect the same during this crisis. From current levels that could mean gold as approaching the $3,000 an ounce level in the next three years.

This Is Still Just Getting Started

The global spread of the coronavirus continues at a fast pace. Over the past week, confirmed cases infection doubled in a week to top 310,000 as of Sunday. The Imperial College of London, considered the world’s most renowned health modeling experts estimate the pandemic could unfold in waves over the next 18 months.

Government Response

In the months ahead, there will be waves of Federal Reserve quantitative easing and massive fiscal stimulus packages in the trillions.

The government will print and borrow money in efforts to stave off another Great Depression. Will it work? The jury has not even heard the case yet. These efforts, while necessary given the magnitude of the crisis, will degrade and devalue paper currency.

The fiscal rescue packages will mortgage the next generation of Americans with ever-greater debt levels. With the nation’s debt already topping $22 trillion, it seems foolish not to add a couple trillion on more now. Yet, this could unleash great inflation, double-digit interest rates and a destabilization of our financial system in the years ahead.

The Fed and the U.S. government are between a rock and a hard place. They have to act.

Many fiscal and monetary ideas will be tried. Some may work, others may not. No matter what, there will be a financial reckoning in the years ahead.

In this environment, gold remains one of the few assets that is recognized around the world as a store of wealth and value. Throughout history and in the future, gold has and will continue to provide investors a safe harbor in the storm.

Be safe,

David

What Questions Do You Have?

This is the first installment of a new weekly message from Blanchard. In the weeks ahead, I will provide a wrap up of the key events of the previous week, along with commentary to keep you informed. Count on us for insightful news, perspective and analysis along with recommendations to protect and preserve your wealth. Blanchard is here for you.

Email questions for me to answer in next week’s Monday Morning Wrap at: [email protected] or email just to let us know if you like this commentary or how we can make it better. Prefer the phone? Call us at 1-800-880-4653. We want to hear from you.

Zero Hour: Three Reasons to Consider Gold During a Federal Reserve Rate Cut

Posted on — Leave a commentOn Sunday the Federal Reserve cut the benchmark interest rate by one percentage point. The result is a near zero rate representing a new economic reality characterized by diminished confidence and near-term fears.

This move is just one of several actions designed to buoy financial support and confidence as global health concerns rise. Less than two weeks ago the Federal Reserve cut rates by half of one percent. Additionally, there are no reserve requirements for banks at the moment. This move is intended to encourage banks to lend money rather than hold it to meet regulatory mandates.

Equity markets have been largely discouraged by these actions. The S&P 500 is now experiencing double digit losses from recent highs. Moreover, Federal Reserve Chair Powell remarked that additional actions are “going to depend on how widely the virus spreads, which is something highly uncertain and I would say unknowable.” In this unknowable time, investors must reassess their positions.

Many are looking to gold. Here are three reasons why:

Gold and Interest Rates Have a Unique Relationship

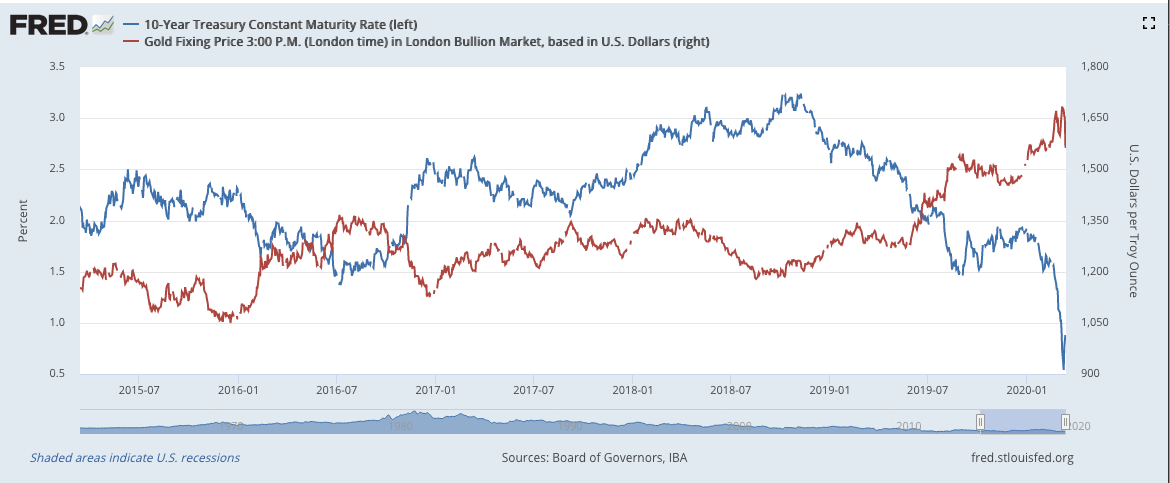

The below chart shows the inverse relationship between the price of gold and the 10-year treasury rate over the last five years. This data serves as an example of the opportunities that can be present during a period of economic shock. Moreover, this relationship has appeared to intensify over recent months. The data suggests that gold could be a stabilizing force in an otherwise fiercely volatile portfolio of stocks and bonds.

Frequently, analysts gauge this relationship by examining a statistical measurement called r-squared. This number represents the degree to which the change in one thing (e.g. the 10-year Treasury rate) can be explained by the change in another thing (e.g. the price of gold). Over the last 10 years the r-squared of 10-year Treasury rates and gold prices has hovered around 31%. However, in 2020 this figure has increased to approximately 68%. This figure seems to indicate that the interest rate changes are exacting a greater influence on the price of gold in recent months.

The Value of Gold is Likely Less Influenced by Closures

Every day governors are issuing statewide closures of bars, nightclubs, and restaurants. More Americans are working from home and staying away from retail stores. The net effect of these mandated, and self-imposed measures is decreased economic activity. This trend will continue for an unknown period of time as coronavirus concerns spread.

The nature of this threat is unique in that it affects all people and nearly all businesses. Put simply, coronavirus can reach anyone. As a result, investors face a future with fewer haven investments. Gold, however, represents a possible exception in that the metal’s value is not dependent on patrons enjoying a nice meal out, or customers going to the store to buy a new set of clothes, or movie goers hitting the local cinema. The value is based on a worldwide acceptance that gold is a store of wealth. This value is also underpinned by its rarity and finite nature.

Gold is Free From Counterparty Risk

Counterparty risk is a term used to describe the risk associated with a business’s ability to meet their debt obligations. When an investor sees the value of their shares plummet because a publicly traded company is no longer able to remain solvent, the investor is suffering from counterparty risk.

Physical gold is free from counterparty risk because the asset does not require any individuals to meet debt payments or remain profitable. Counterparty risk becomes an escalating threat in an unstable economy because weakened business conditions make it difficult for companies to drive revenue which, in turn, creates difficulty in servicing debt. Too often the investors suffer from this scenario in the form of decreased share value.

Despite health concerns and pervasive uncertainty, forward-thinking investors are seizing unprecedented opportunities to strengthen their portfolio.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Can Fed’s big-gun response work?

Posted on — Leave a commentWe woke up to a Monday like no other.

Daily life around the world is grinding to a halt as the virus crisis spreads. The Federal Reserve stepped in on Sunday with a dramatic, all-out attack on the growing economic and health crisis spurred by COVID-19.

In the second emergency rate cut this month, the Fed slashed interest rates to 0% – 0.25%, the lowest level since the 2008 global financial crisis.

In recent days, the U.S. stock market crashed into a bear market in a stunning 22 calendar days, making this the quickest collapse since WWII.

Despite the Fed’s emergency action, stocks continue to plunge, hitting “limit down” in pre-market action Monday. Even circuit breakers and 0% interest rates can’t stop the carnage and the market appears ready to fall further today.

The Fed also announced it is restarting “quantitative easing” also known as bond buying, in an attempt to keep markets moving.

What Lies Ahead?

The country is facing an economic challenge of gargantuan proportion.

While economists expect a recession given the health-inspired required closures around the country. From restaurants and bars to schools, the country is closing down.

The U.S. economy hasn’t even officially entered a recession, yet the Fed is already out of bullets. It used up its stimulus powers and hit the zero level before we even registered a fall in GDP in two consecutive quarters (the official definition of a recession).

On the fiscal side, policymakers already enacted a huge tax cut in recent years, which increased the U.S. debt. The Fed is out of bullets. The government has already cut taxes. The only options left are negative interest rates, more money printing and expensive bailout packages that will need to be paid back by tomorrow’s workers.

The failure of the government to improve the country’s financial situation in good economic times, leaves our country faced with bleak options during bad economic times.

What lies ahead will mortgage the next generation’s economic future and further tie the hands of policy makers to spend on programs that matter most, as an increasing amount of funds will be required to go to interest on debt.

In this Environment, Gold Shines Brightly

Gold is a hard asset that can’t be devalued by the Fed’s printing presses. As investors across the country watch their net worth fall by the minute, owning gold makes more sense than ever in order to preserve and protect our wealth.

Yes, gold is selling off now. In large part because investors are selling what they can right now to meet stock market margin calls.

The recent stock market gains were leveraged to the hilt with margin buying. The stock market crash has brokerage firms around the country calling in their chips. Investors who own gold – are selling to meet their margin requirements.

Gold is acting as the insurance policy that it is – a financial instrument that provides liquidity during times of crisis.

In these uncertain times, it can be helpful to talk with a trusted advisor. Blanchard is here for you. Please call us today if you have questions. We have answers.

Stay safe.

PS: News is rapidly evolving. For the latest on precious metals, be sure to follow us on Facebook and Twitter, read our latest articles and download our app.

Strategizing Investments as The Global Economy Enters a Pandemic

Posted on — Leave a commentAs of this article there have been 121,061 confirmed cases of the coronavirus worldwide resulting in 4,368 deaths. Recently, the World Health Organization declared the coronavirus a pandemic. As a result, businesses have begun to feel the effects. Supply chains have been disrupted, consumers are distracted, and equity markets are in steep decline. Since the start of the year the S&P 500 has plummeted more than 15%.

In the opening remarks of the March 11th World Health Organization (WHO) briefing we learned that “In the past two weeks, the number of cases of COVID-19 outside China has increased 13-fold, and the number of affected countries has tripled.” This message, and the numbers behind it, have incited fear in equity markets. Goldman’s chief equity strategist, David Kostin has taken this recent upheaval as a clear indication that “the S&P 500 bull market will soon end.” Their research has led them to conclude that the S&P 500 will decline by 3%, 15%, and 12% in the first, second, and third quarter of this year respectively.

The essential problem facing both medical professionals and investors is the same: uncertainty. There is still much that is unknown about the coronavirus. As a result, the future is difficult to predict. This obscurity has left investors fleeing to assets that are more durable stores of value during turmoil. For many, gold is such a place.

In response to this strategy, experts at the World Gold Council have referenced gold pricing data from the 2003 SARS epidemic as a corollary. While there are many differences between the coronavirus and SARS, both share the characteristics of being a health crisis that looms large in the global psyche. During the SARS epidemic gold, at one point, reached an “intra-quarter maximum of 16%.” Moreover, as recently as late February the Wall Street Journal reported that gold reached a “fresh seven-year high as investors flee riskier markets.” Like any crisis, the coronavirus has presented investors with reasons to be fearful, while also offering opportunities.

Gold may provide short-term appreciation amid turmoil. However, for many, the benefits are downstream. An investment in gold today represents a way to potentially limit volatility that is likely to persist for some time. Two days ago, the CBOE Volatility Index (VIX), a popular measure of investor sentiment, reached its highest point since the global financial crisis. The VIX rises when investors are fearful and falls when investors are confident.

The Bottom Line:

Medical professionals are unclear on what lies ahead, but they have seen enough to know it is not good and that the situation will likely worsen before improvements begin. As the WHO Director-General remarked, “This is not just a public health crisis, it is a crisis that will touch every sector – so every sector and every individual must be involved in the fight.”

Taking a cue from this uncertainty, equity and bond markets have reacted with plummeting values and soaring volatility. While frightening, investors have an opportunity to reconsider their strategy and reevaluate their asset allocation in the context of what will prove to be “the new normal” in the coming months. Gold should be part of that allocation model.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.