The Gold – U.S. Dollar Connection

Posted on — Leave a commentInvesting in gold may have felt like a roller coaster ride this year.

Gold began 2021 just above the $1,900 an ounce level. Then, gold retreated to around $1,680 in late March. By late May, gold prices surged back above $1,900 an ounce. Recently, gold dipped to about $1,800 an ounce.

The price of gold is influenced by many factors. Key drivers of gold include interest rates, inflation, the amount of U.S. dollars in circulation (money supply), U.S. debt levels, political and economic stability and many other factors including the level of the U.S. dollar.

Today, we’ll focus in on a recent influence that has pressured gold lower lately – the U.S. dollar.

Economists like to call the connection between the U.S. dollar and gold – an inverse correlation. In simple terms, that means when the U.S. dollar climbs – gold tends to fall and the opposite is true as well. When the U.S. dollar falls, gold tends to increase in price.

As of early July, the U.S. Dollar index is 3% higher on the year, while gold is about 5% lower on the year.

The surprise strength in the U.S. dollar has weighed on gold in recent weeks.

Looking back 20 years – what’s the long-term dollar trend?

Let’s look at current levels in historical context. In June 2001, or 20 years ago, the U.S. dollar index stood at nearly 119.00.

Today? The U.S. dollar index stands at 91.46.

The long-term trend of the U.S. dollar is down. There are many reasons for this – including the gigantic amount of U.S. government debt – which now stands at a historic all-time high at $28.4 trillion.

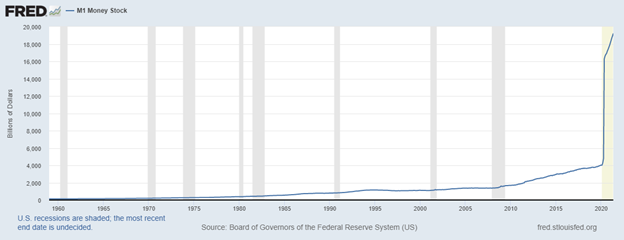

Another reason for the downtrend in the U.S. dollar? The Federal Reserve keeps expanding the money supply – or printing more dollars for circulation. Take a look at this chart from the St. Louis Federal Reserve (FRED). The amount of M1 money stock has literally gone straight up in recent years.

The long-term downtrend in the U.S. dollar is an important positive factor for gold investors in the years ahead, and is one of the key drivers that is expected to push gold to new all-time highs.

As the Federal Reserve continues to devalue our dollar by printing more, and the U.S. government continues to put our credit at risk by taking on more debt – gold will continue to increase in value.

What does all this mean for gold ahead?

The Wells Fargo Investment Institute published a new investment strategy report on July 6. Here’s what they said.

“Gold has had a rough 2021 because the U.S. dollar has surprisingly rallied.”

What else did they say?

“We think gold represents good value at today’s levels. Investor sentiment appears overly negative and we are expecting the U.S. dollar to fade and real interest rates to remain low through 2021.”

By year-end, the Wells Fargo Investment Institute targets gold in the $2,000-$2,100 range.

That represents a 16% increase from gold’s level today.

The long-term drivers to push the U.S. dollar lower remain in place. The U.S. debt and the massive dollar money supply aren’t going away anytime soon.

That means today’s gold market offers you, the long-term investor, a tremendous opportunity. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

What Investors Can Learn from the 1970’s Runaway Inflation

Posted on — Leave a commentEvery time you flip on the TV, read an article or listen to a radio show – there’s more news about inflation.

What is inflation exactly? The simple definition is – inflation occurs when demand exceeds supply in an economy.

Are we seeing that now? Yes, indeed.

Easy Federal Reserve monetary policies, exploding money supply growth and massive government spending are helping to push consumer prices higher.

That leaves consumers chasing after fewer goods and services amid shortages and pent-up demand, which means everything costs more now. But, you already knew that, right?

Consumer prices surged a whopping 5% in May – pushing inflation to a 13-year high.

If you think inflation is bad now – you haven’t seen anything yet.

Americans of a certain generation will remember the awful economic days in the 1970s.

An oil shock sent gas prices spiraling higher and meant Americans waited in long lines to fill their tank. Meat prices spiked – and many Americans went without. Prices on just about everything rose across the board.

It was called The Great Inflation and lasted from 1965-1982.

President Nixon tried to intervene – in what became known as the Nixon shock. In a surprise presidential telecast to the nation on the eve of August 15, 1971 – Nixon declared wage and price controls. These were intended to be temporary measures to push inflation lower and fight against the ‘international money speculators’ who were selling the U.S. dollar on global markets.

Here is what Nixon said on that fateful day: “I am today ordering a freeze on all prices and wages throughout the United States for a period of 90 days.”

When his price controls were lifted – yep you guessed it, prices kept moving higher.

By the summer of 1982, inflation in the U.S. hit 14.5%.

President Gerald Ford called inflation “Public Enemy Number One.” President Jimmy Carter said it was our country’s most pressing domestic problem.

What finally solved the inflation problem?

When Fed chairman Paul Volcker raised interest rates to 20%. The economy entered a severe recession – it was painful medicine to cure inflation.

Will we see runaway inflation like we did in the 1970’s?

Time will tell. It is true that the Federal Reserve is not proactively acting to stem the fast-rising inflation we are seeing now. At its Fed meeting this month, the central bank left interest rates at rock-bottom zero. Fed officials said interest rate hikes could come as soon as 2023 – moving up the timeline – after previously saying in March that it saw no increases until at least 2024.

Still, 2023 is at least 18 months away.

How Has Gold Performed When Inflation Rises?

Here’s what the Wells Fargo Investment Institute said on June 22:

“Our research shows that investments associated with tangible assets may be an option for investors concerned with higher inflation.”

The firm noted that “Since 2000, rising inflation typically happened in environments of economic expansion and rising interest rates, a backdrop a lot like what we see now…Commodities including oil and gold, also thrived. Commodity values have typically risen as demand has built up and inflation has spiked.”

Since 2000, Wells Fargo found that during periods of rising inflation – these assets performed best:

- Oil + 41%

- Emerging Market Equities +18%

- Gold +16%.

This is an important lesson for investors to understand today: Gold has produced double-digit returns during inflationary periods. If you are concerned about inflation, there are actions you can take now to protect and grow your money.

Reposition your portfolio for the fast-growing inflationary influences we see now. Consider increasing your allocation to gold so you can continue growing your wealth even during inflationary times.

If you’d like help understanding how much gold could be appropriate for your investment time horizon and long-term financial goals, call a Blanchard portfolio manager today at 1-800-880-4653 for a complimentary portfolio review.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Untangling the Connection Between Interest Rates and Gold

Posted on — Leave a commentIn recent days, the Federal Reserve projected that they might make two interest rate increases by 2023. The equities market reacted decisively as the Dow fell more than 500 points, resulting in the worst week for the index since the fourth quarter of last year.

The possibility of interest rate hikes has many investors reconsidering their near-term plans, including those holding gold. The challenge, however, is untangling the connection between interest rates and gold because the relationship between the two is complicated and easy to misinterpret.

Many people hold the notion that as interest rates rise the price of gold decreases. The reason: a higher interest rate makes fixed-income investments more attractive. As a result, more investors allocate their money to bonds and money market funds. This response leaves less investible cash for assets like gold, which brings the price down. The problem with this thinking is that it ignores the fact that the correlation between interest rates and gold is less than 30%, and therefore not significant.

In truth, their have been periods during which gold has appreciated in price dramatically while interest rates soared. For example, by the late 1970s and early 1980s there was a strong positive correlation between gold prices and interest rates as both surged in tandem with each other. In contrast, gold had a historic run up in price in the 2000s while interest rates plummeted.

These events illustrate a simple fact: there is no consistency between the movement of interest rates and gold prices. Sometimes the two appear to move in sync with one another. At other times they diverge. There is no predictability to these movements. The popular perception that the movement of gold prices and interest rates are linked is an illusion brought on by our inherent need as humans to draw connections between aspects of our world. The need to link unrelated things is a result of trying to navigate an increasingly complex world.

For example, consider that the correlation between the divorce rate in Maine, and the per capita consumption of margarine is an astounding 99.2%. Or consider that the correlation between the total revenue generated by arcades and computer science doctorates awarded in the US is 98.5%. These purely coincidental correlations demonstrate just how easy it can be to see links that do not exist.

Gold prices are not driven by interest rate movements. The real driver is supply and demand. The simplicity of this statement can be made even simpler by noting that the most powerful influence on gold prices is demand because changes to supply occur slowly given the time it takes to locate new below ground stores and bring new mines online.

The recent headlines urging investors to react to moves that will not occur until 2023 are simply noise. Prudent investors focused on the long-term ignore the sensational stories and continue to hold a well-balanced portfolio knowing that interest rates will have a limited impact on their gold if at all.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Long Journey to the Large Head Indian Princess Gold Dollar Coin

Posted on — Leave a commentPeople have used gold as money for thousands of years.

Yet here in America, it was the Act of March 3, 1849 that first established coinage of a U.S. gold dollar. Prior to that, early Americans used silver and gold coins brought from Europe, in addition to those made in Spanish possession in the New World.

The first gold dollar type that was struck here in the U.S. was the Liberty Head, which was issued from 1849 through 1854.

When the Liberty Head first appeared in circulation, the $1 gold coin was tiny – a mere 13 millimeters in diameter. For context that is smaller than our modern-day Roosevelt dime.

A common complaint?

Many Americans griped it was so small that it was easily lost. In 1849, losing a dollar was no small matter. For many it equaled a full day’s pay.

In 1854, the U.S. Mint took action to solve this issue and struck a new gold dollar type called the Small Head Indian Princess gold dollar. The Mint increased the coin’s diameter to 15 millimeters. This is known today among numismatic collectors as Type 2. The Type 2 gold dollar was minted from 1854 through 1856.

Guess what? The Type 2 dollar had problems too.

Chief Engraver James B. Longacre made the coin’s relief too high on the obverse. That meant very few coins were fully struck. Nearly all of the Small Head Indian Princess gold dollars wore down quickly while in circulation.

In this case, it was the third try that was the charm. The U.S. Mint struck a new Type 3 gold dollar known as the Large Head Indian Princess gold dollar from 1856 through 1889.

The Type 3 gold dollar’s size was appropriate and the design had staying power. For more than 30 years, the U.S. Mint struck this fascinating coin, until the denomination was ended in 1889.

While only 1,105 proof gold dollars were struck in 1885, many were utilized as love tokens – a major fad of the time. In the 1880s if a man wanted to propose marriage to a woman, he would take a proof gold dollar like this one and engrave it with the initials from his family name and the girl’s first name. If the woman accepted it and wore it – the love token stood as a symbol to the world of their engagement.

This fully struck gold dollar boasts a warm honey gold tone and has outstanding historical appeal. See it here.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Estate Planning Part Two: Leaving your Legacy and Liquidation with Rare Coins and Bullion

Posted on — Leave a commentThere are four major benefits to including rare coins and bullion in your estate plan:

- Private transfer with little to no paperwork.

- Diversification with steadily appreciating assets.

- It’s personal – your legacy.

- Simple liquidation process.

Yesterday, we explored the first two benefits in this article on estate planning.

Today, we’ll explore the impact and memories you can leave to your loved ones when numismatics are part of your estate plan and the tangible assets liquidation process. We welcome your questions if you would like to build a legacy through a numismatic portfolio or if you have inherited bullion or rare coins. If you are an attorney working with clients who don’t know how to liquidate a tangible assets estate, we can help guide your clients through their options with a no-obligation, complimentary phone consultation. Let’s get started.

It’s personal – your legacy.

Perhaps one of the best aspects about leaving tangible assets to your loved ones is that it’s personal.

Numismatic collections are unique and one of a kind. A numismatic collection represents not only significant wealth and value – but also represents United States history, your passions and ultimately are a reflection of you and your hand-picked choices over time.

You have the opportunity to customize numismatic collections to match the interest of each of your heirs.

For example, let’s say you have three daughters – you could build a special series of coins for each one of them – customized to their personalities or interests. Perhaps you have one daughter who admires early America, another who likes shipwrecks, and another who adores sculptures. We can help you build a one-of-a-kind series – for each of them! Imagine passing on such a personal, meaningful and valuable legacy to your loved ones. Blanchard can provide histories of each of the coins with an explanation of why you chose to include those coins in a certain collection, if you’d like.

Hand-picking coins for your heirs allows you to leave your signature on your estate in a much more meaningful way than passing down a brokerage account.

Liquidating the estate assets

For 46 years, Blanchard has helped thousands of individuals and families liquidate tangible asset portfolios. Our firm can assist you or your client even if we didn’t help build the coin portfolio.

When it comes to unraveling an estate, liquidating tangible assets is a very simple transaction. It will likely be one of the simplest parts of any estate to liquidate.

We also work with heirs to determine if they want to continue to hold onto the entire collection, or sell a portion or all of it. We provide these consultation services at no charge to heirs. We can provide valuations to assist them as they decide they want to sell or hold onto and continue to build the legacy that you’ve left to them.

If your heirs decide to sell, they simply need to send us the tangible asset and we will wire transfer a check with little to no paperwork involved.

Who is this type of estate planning appropriate for? Everybody who is concerned about the value of their estate and the impact it will have on their heirs.

Tangible assets like rare coins and gold bullion are an asset just like any other assets like stocks or bonds. You can place them into a trust or as part of your estate just like any other asset they own or simply tell your heirs where your collection is stored.

About Blanchard & Company

In 1975, Jim Blanchard founded his family-run investment firm – Blanchard and Company, Inc., in New Orleans, Louisiana. Blanchard and Company has deep roots in the numismatic community and is widely regarded as the most respected tangible asset investment firm in the country. Blanchard has served over 450,000 investors.

Our meticulous coin acquisition is unrivaled, and it reflects the union of our superior business principles and impeccable rare coin selection methods. We proudly offer coins handpicked by John Albanese, who is the top numismatist and coin grader working in the rare coin market today.

Coin Grading – CAC

Albanese is America’s leading professional numismatist, and he is a world-renowned authority on coin grading and the rare coin market. He co-founded Professional Coin Grading Service (PCGS) before launching Numismatic Guaranty Corporation (NGC), where he personally graded more than one million coins. He also founded the now industry standard, CAC (Certified Acceptance Corporation) coin grading and verification firm.

A little history: Dealers themselves graded rare coins prior to the mid-1980s, raising serious conflict of interest issues that often resulted in fraudulent grading. The third-party grading services were established in response to this fraud, developing standards and practices that are now widely accepted. These organizations neither buy nor sell coins, so there are no conflicts of interest.

Today the stringent coin grading standards in place have removed those issues and concerns.

And CAC stickers increase the value of the verified coins as they ensure to both buyer and seller the true value of the rarity.

If you have any questions about using tangible assets in estate planning or want to liquidate a portfolio for yourself or for a client, please reach out to one of our portfolio managers at 1-800-880-4653. Mention you read this article and would like a no-obligation, complimentary consultation with an estate planning expert.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Gold retreats on Fed news

Posted on — Leave a commentDon’t Expect Lower Gold Prices to Last Long

Gold prices tumbled $50 an ounce this afternoon (at the time of writing) after the Federal Reserve announced earlier than expected interest rate hikes.

In March, no Fed officials expected interest rate hikes in 2023.

Today? The new Fed projections point to two interest rate hikes in 2023.

The Fed pointed to hotter inflation and faster economic growth as the reason for the change.

The Fed slashed its benchmark interest rate to zero in March 2020 as the Covid crisis triggered a recession and stock market crash.

Despite recent inflation data which showed consumer prices at their highest level since 2008, the Fed is continuing to hold interest rates at rock bottom zero percent level. Even today’s new estimates don’t project interest rate hikes for at least 18 months.

What is the Fed waiting for?

The Fed, the economy, the stock market – everyone is hooked on easy money policies. Despite evidence of fast economic growth and rising inflation – interest rates are stuck at zero.

Expect today’s pullback in gold prices to be short-lived.

Why? The Fed is ignoring the inflation data.

The Fed is continuing to buy $120 billion in Treasury and agency securities each month. The easy money policies are here to stay, despite hard evidence that inflation is rising.

Billionaire hedge fund manager Paul Tudor Jones recommended buying gold this week.

“If they [the Fed] treat these numbers — which were material events, they were very material — if they treat them with nonchalance, I think it’s just a green light to bet heavily on every inflation trade,” Jones told CNBC’s Squawk Box.

Here’s what Jones, who called the stock market crash in 1987, advised on Monday:

- “Go all in on the inflation trade.”

- “Buy gold.”

Inflation rose 5% in May. The economy is expanding at a 10.3% growth pace in the second quarter, according to the Atlanta Fed’s GDPNow real-time model.

And, the Fed is doing nothing?

While you can’t control the Fed – you can act now to protect your wealth. Have you considered buying more gold? Today’s lower prices won’t last long.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How to Incorporate Tangible Assets into Your Estate Plan

Posted on — Leave a commentAs the saying goes, nothing is certain in life except death and taxes.

While no one likes to think about their own mortality, developing your estate plan is a loving way to care for your family even after you are gone. If you don’t develop your estate plan, state law will decide for you and the results may be very different than you intended.

As you develop your estate plan, there are many benefits to including tangible assets like rare coins or gold bullion as a portion of your legacy for your loved ones.

There are four major benefits to including tangible assets in your estate plan:

- Private transfer with little to no paperwork.

- Diversification with steadily appreciating assets.

- It’s personal – your legacy.

- Simple liquidation process.

In this article, we’ll explore the first two benefits and will conclude our estate planning article series tomorrow with numbers three and four. Let’s get started.

Private transfer with little to no paperwork.

Owning rare coins or gold bullion is a simple and private method of transferring wealth to whomever you choose.

If you have a bank safe deposit box or a home safe, you can simply leave instructions or inform your family where to find and retrieve your coins or bullion.

Simply put, whoever holds it, owns it.

If your heirs choose to liquidate certain numismatic products, typically pre-1933 U.S. coins and 1 ounce American Gold Eagle coins, there are little to no reporting requirements for dealers.

Diversification with steadily appreciating assets.

Just as you seek to diversify your investment portfolio, including tangible assets in your estate plan is an effective and prudent diversification strategy. In previous generations, people would leave cash, CDs or bonds to their children – and at that time these were great assets.

In today’s modern era of Federal Reserve money printing, leaving your heirs cash means you are passing on an asset that is steadily depreciating and losing value. Sadly, the government is devaluing your lifetime of hard work with its current approach of dramatically increasing the U.S. money supply.

Compare U.S. dollars to gold and rare coins – and the latter are a steadily appreciating long-term asset that can never be printed by the government. There is a rarity and tangible asset component of rare coins and bullion that represents real, true and long-lasting value.

In fact, gold is the best performing asset class over the past 20 years, with an 8.8% annualized return, according to analysis by long-time industry analyst Mark Hulbert. Gold bullion returns over the past 20 years beat out the S&P 500, Long-term Treasuries, International Stocks, the NASDAQ 100 and even Intermediate-term Treasuries.

Next up? Leaving your personal legacy. Indeed…perhaps one of the best aspects about leaving tangible assets to your loved ones is that it’s personal. Read Part Two of our Estate Planning series where we will explore building a personal legacy and the simple estate liquidation process. Can’t wait to get started? Call Blanchard at 1-800-880-4653. Mention that you read this article and would like a no-obligation, complimentary consultation with a portfolio manager who can answer your tangible assets estate planning questions.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Many Lives of the 1838 $5 Half Eagle

Posted on — Leave a commentThe 1838 $5 Half Eagle represents one of many designs to a beautiful coin that had a circulation spanning more than one hundred years, between 1795 and 1929. The piece, consisting almost entirely of gold, was originally enacted in 1792 and was the first gold coin issued by the United States.

In its first iteration, the coin was composed of .9167 gold, and .0833 copper and silver. The original design was the work of United States Mint Chief Engraver Robert Scot. Scot had his start engraving plates for Virginia currency in the late 1700s. By 1781, Scot moved to Philadelphia to continue and expand his engraving work, eventually completing work for the Superintendent of the Office of Finance of the United States. In fact, some of this engraving work was for paper currency that would eventually fund the Siege of Yorktown. This permanently connected Scot to what would be the last major battle of the American Revolutionary War and a decisive win for George Washington. Scot’s connection to the history of the country’s formation became even stronger when, most likely, he became the engraver of the Great Seal shortly after it was designed for the Declaration of Independence.

Once Scot became the Chief Engraver at the United States Mint, he was asked to design coins for the U.S. that included eagle imagery and were “emblematic of liberty.” The prevalence of his work among items that have become historical cannot be understated. In addition to his coin work and his engraving work on the Great Seal, he also engraved rare stamp dies for each state, the seal for the U.S. Navy Department, and seal dies for the U.S. Department of State.

The original design of the Half Eagle coin was known as the “Turban Head,” and has imagery that is far removed from the 1838 design. Here there is a capped portrait of Liberty facing right and a small eagle is depicted on the reverse. By 1807 the design changed again. This iteration is known as the “Draped Bust” design. One of the several changes was the decision to include a “5 D” on one side of the coin to represent its value of $5.

The next version, which includes the 1838 issue, is known as the “Classic Head” and was developed in 1834. By the time this design took shape the coin’s value was greater than the face value of $5. In response, the US Mint changed the composition of the coin, reducing the gold content to .899 and .100 silver and copper. The weight and diameter of the coin were also reduced. The phrase “E PLURIBUS UNUM” was removed. Before the 1838 version was minted the gold content was changed again, this time increasing to .900.

Throughout its history the $5 coin was popular enough to be the only denomination minted at eight of the US Mints. After the “Classic Head” the “Liberty Head” followed. The final iteration was the dramatically redesigned “Indian Head.”

The coin’s imagery is as enduring as all of Scot’s other work and the evolution of the design is representative of the changing national identity.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Silver Steals Spotlight

Posted on — Leave a commentGold isn’t the only precious metal on a tear lately. Silver surged 19% from its March low into its mid-May high at $28.57 an ounce.

What’s behind the big move in silver?

Concerns over inflation, a declining U.S. dollar and rising industrial demand as the global economy rebounds are sending silver prices higher.

In fact, the booming investment demand for physical silver is causing supply disruptions at the U.S. Mint.

Here’s what the U.S. Mint said in a June 2 public statement: “The Mint is being impacted by silver blank shortages among its suppliers. The demand for many of our bullion and numismatic products is at record heights and increasingly outpacing the supply of silver blanks available through our suppliers…As demand remains greater than supply, the reality is such that not everyone will be able to purchase a coin.“

What lies ahead for silver?

Demand for silver comes from both industry, jewelry, silverware as well as investment demand as investors diversify their portfolios with physical silver as a store of value.

While investment demand remains strong now, it could be industrial demand that provides the next leg higher in the silver market.

Silver is a key component in both solar panels and electric vehicles, and will also be used in the nation’s shift to 5G wireless network technology.

The industrial demand for silver is set to soar if President Biden’s renewable energy plan is approved – with analysts expecting the metal to climb the $50 an ounce level. That would top silver’s all-time high at $48.70 in 1980, according to FactSet.

The current pause in the recent silver rally offers investors an excellent buying opportunity.

CPM Group managing partner Jeffrey Christian said recently that he expects a renewed uptrend in silver later this year and then “at some point it will accelerate and probably blow past the record prices of around US$50/oz we saw in 1980 and then in 2011.”

Silver investment demand set a new record higher in 2020 – topping 80 million ounces. Investors continue to turn to the safety of silver in the wake of the massive liquidity pulsing through the financial markets in the wake of unprecedented monetary and fiscal policy.

The rising silver investment demand trend is expected to remain hot this year, with a forecast of 120 million ounces in net purchases.

Are you positioned to take advantage of the next wave of silver gains?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Gobrecht Dollar Experiment

Posted on — Leave a commentIn the 1830’s, the concept of a silver coin for use in circulation was still something of an experiment. The U.S. had not yet had a silver coin minted for the purposes of everyday use by citizens. The Gobrecht dollar became that experiment and by 1835 mint officials were ready to give it a try.

They wanted to see how such a coin would be received by the public. The coin gets its name from Philadelphia medalist Christian Gobrecht, who was hired as a last-minute replacement to fulfill the responsibilities of the engraver. After much discussion among Mint director Robert Patterson and Philadelphia artists Titian Peale and Thomas Sully, it was agreed that the design would feature a soaring eagle.

This choice was partially driven by the urge to differentiate the coin from so many other minted pieces featuring the heraldic eagle. When conceptualizing the look of the coin, Gobrecht and others turned to Peter, the Mint’s pet eagle, as inspiration. Sadly, not long after, Peter became caught in a coining press and died. He was preserved by a taxidermist and remains on display at the Mint today.

Gobrecht was provided with rough concept sketches and tasked with turning those ideas into final etchings. By October of 1835, his copper engravings were complete. This work would be used to generate a series of prints to be distributed to government officials for approval. Soon after, Gobrecht and others received the authorization to move forward and begin creating the dies. Soon thereafter, Mint officials solicited the opinions of the general public.

The following year, Chief Coiner Adam Eckfeldt began striking the production dies. One of the last changes to the piece came from Patterson, who required that the design include “C. GOBRECHT F” to illustrate that Gobrecht was the artist of the work. The first pieces were struck in December 1836.

The design was praised, but many reviewers didn’t like the decision to include Gobrecht’s name and suggested that it be removed. Soon after, even Gobrecht himself requested that his name be removed from the coin. Instead, Patterson decided that Gobrecht’s name would remain but that the size would be reduced and that the placement would change.

As production began Congress started to change the composition standards for silver coins and required that all silver pieces must consist of 90% silver rather than the 89.2% previously required. As a result, 1,000 Gobrecht coins struck in 1836 were 89.2% silver, and 600 were 90% silver. In the following years other design changes would emerge. The 1838 versions removed the stars from the reverse. Some of the coins struck that same year did not include Gobrecht’s initials.

The total minting of the coins throughout their entire run was only about 1,900 pieces. When production ended the Mint began producing the Seated Liberty dollar which used the same obverse design. Today the coins are highly sought after for their unique place in history during a time of transition, as the U.S. Mint was still exploring ways to introduce art into the economics of currency.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.